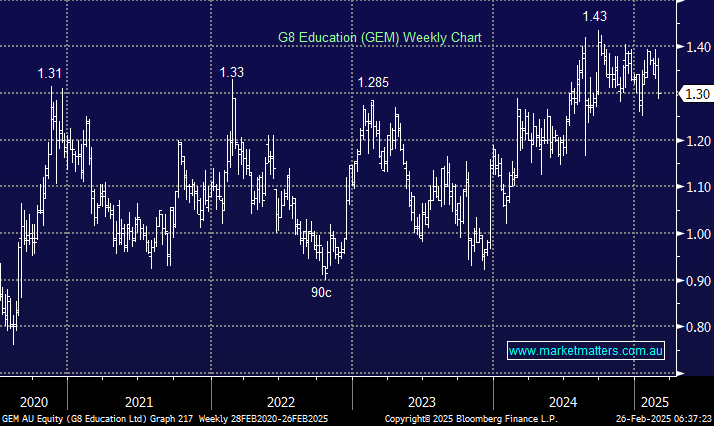

2024 was an important year for childcare operator G8 Education, where they addressed many of the lingering issues within their business, ultimately reporting a solid scorecard yesterday. They are a December year-end, so we got FY24 earnings that were a good improvement on FY23, showing the programs around workforce, costs, and occupancy levels are working (to varying degrees). This is a stock we’ve held for income in the past (we don’t own it now), and underlying earnings growth of 14.2% for the year was a good outcome for a stock trading on an Est PE of ~14x.

- Revenue +3.3% to $1.012bn, up 3.3% and in line with expectations.

- Net Profit of $72.4m was ahead of $70.9m expected and up 14.2% y/y.

- Occupancy at 70.7%, up 0.3.% (still a bit weak)

- 3.5cps FF 2H dividend was in line with expectations, taking the FY payout to 5.5cps fully franked.

Occupancy remains the key for GEM, and at ~70% in FY24, it’s still too low in our view. While we appreciate tough trading conditions across the sector as affordability impacted families, the market is currently forecasting earnings growth here of 8-10% in FY25 driving an expected 15% increase in the dividend. Trading to start FY25 does not support that trajectory with ‘spot’ occupancy running at 61.8%, 3.5 percentage points lower than the same time last year.

While it’s only early days for GEM in FY25 and rate cuts will help, we’re not chuffed by their high level of vacancy. We would want to see either an improvement here or a move lower in the share price nearer ~$1.10 for the risk/reward to stack up, i.e. taking the bet on improved occupancy to come requires a lower price.