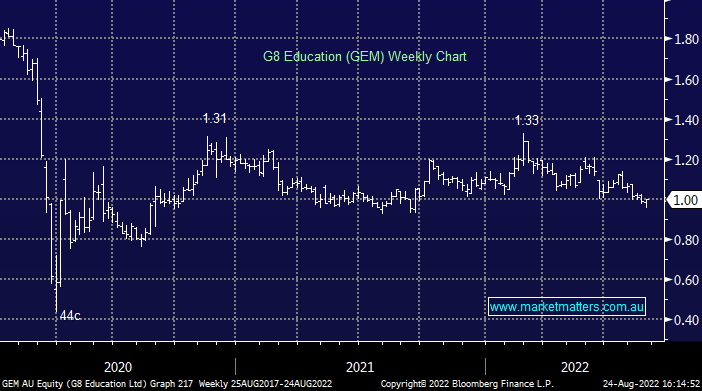

GEM +2.06%: 1H22 results out this morning for the Childcare operator and they were as weak as we had expected, however, there are tangible signs of improvement that bodes well for the 2H. Operating revenue of $416.7m was around 5% above expectations while underlying earnings before interest & tax (EBIT) of $21m was also a slight beat to low expectations. They have guided to a strong 2H22 driven by better occupancy meeting higher prices, partially offset by the continuing impost of wage inflation and absenteeism. In the first half, occupancy was running at 67.1% however they have experienced a strong rebound from the low in early March to be sitting at 73.8% as at 21st August. They are continuing to work on their cost base, have a strong balance sheet and continue to buy back shares on market. While the dividend was low (1c), this is expected to increase to 4.5c at the FY result.

scroll

Question asked

Question asked

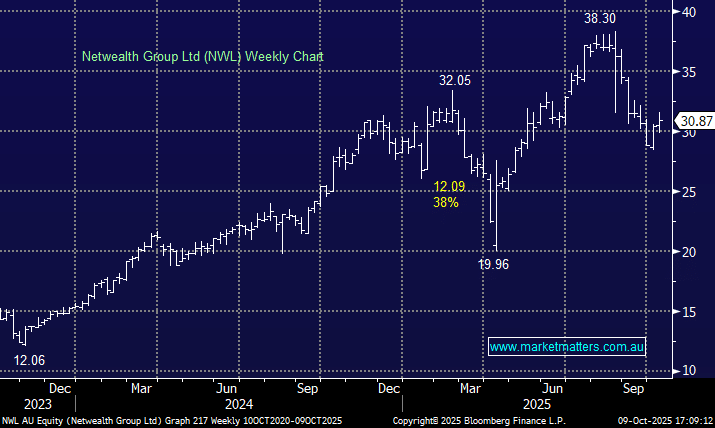

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM will retain GEM in the Income Portfolio

Add To Hit List

Related Q&A

What does MM think of RVR & GEM?

Does MM like GEM moving forward?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.