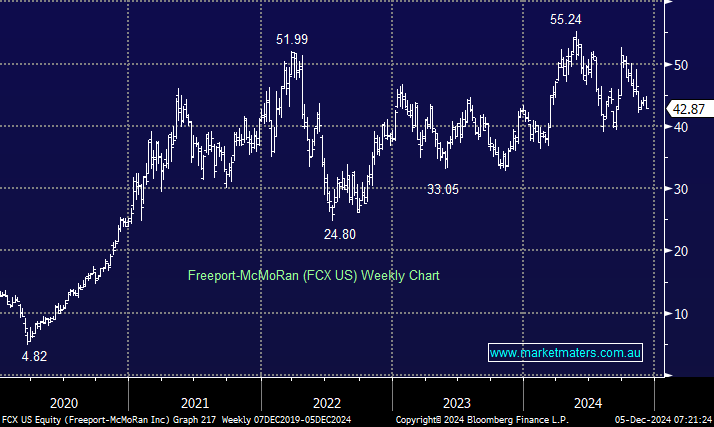

FCX is a major $US61bn resource beast MM has touched on a few times through 2024; the company generates approximately 75–80% of its revenue from copper (Cu), with the remainder coming from gold and molybdenum sales. Through 2024, FCX has advanced around 8i% compared to Sandfire (SFR), which has powered over 40% higher. In this case, SFR benefits from the scarcity of Cu alternatives for the local bourse – we wouldn’t fight this particular relative performance skew into 2025.

- We like FCX, but its performance is understandably linked to the Cu price – MM owns FCX in our International Companies Portfolio.

- We remain very bullish toward Cu in the medium term from a supply/demand perspective, as energy transformation will significantly increase demand for the industrial metal.