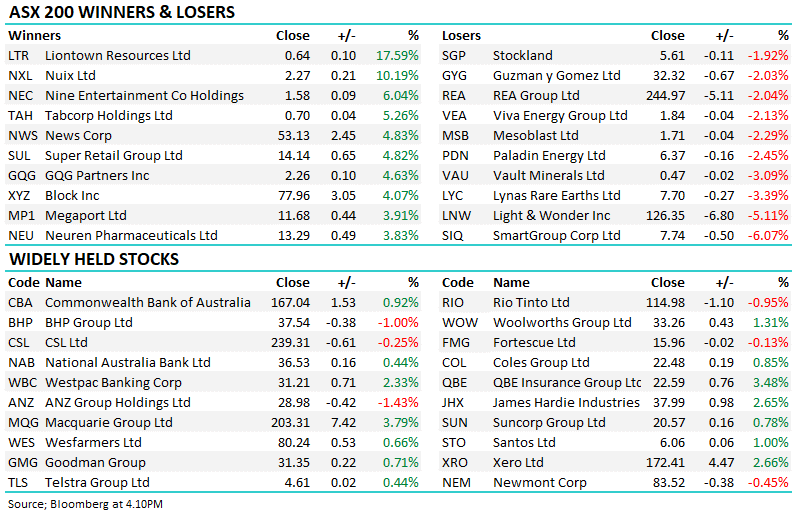

In the 1H of the year investors have been prepared to pay increasingly high prices for earnings certainty, propelling some stocks ever higher, while pushing others, ever lower. At MM we believe a period of performance catch-up is on the menu for some of the more ‘unloved’ names of FY23. When we consider Woolworths (WOW) as an example, it’s easy to comprehend why cautious investors have ploughed funds into this well-managed retailer of necessities that enjoys scale across their supply chain, however, when investor perception does shift, we believe stocks like WOW could be used as ‘funding vehicles’ for a foray up the risk curve.

There is little doubt that Woolies is a quality defensive play but it’s also vulnerable to a slowdown in food spending. Interestingly earnings don’t seem to follow spending as closely as the share price does, we believe the current 28x PE ratio is extremely rich, earnings are still below 2015 levels, but the PE has doubled which paints a very unappealing risk/reward profile in our opinion.

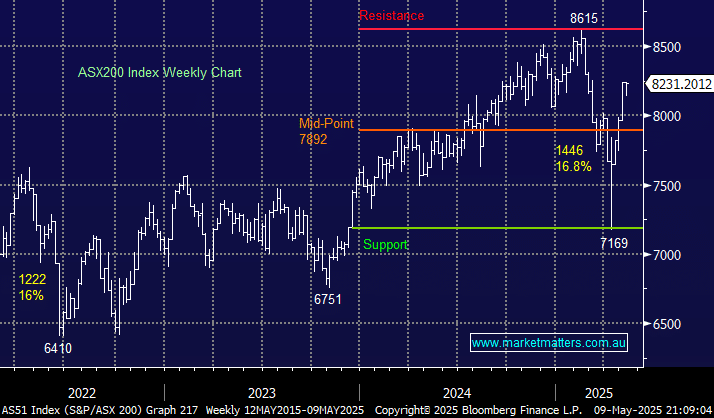

- Markets look into the future, the last year has seen worried investors pile into defensive/safe plays but in our opinion its driven relative valuations toward untenable levels.