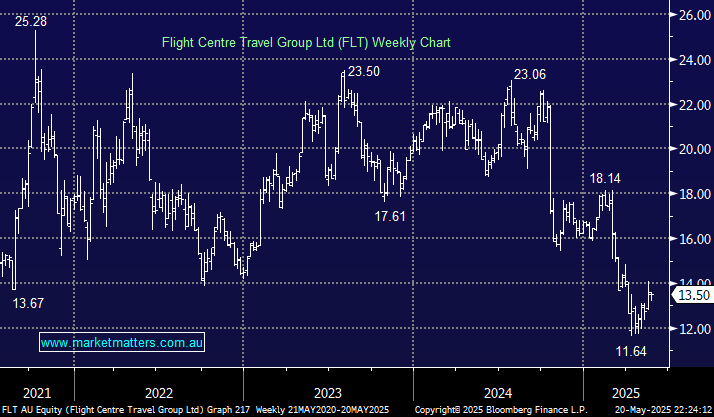

The travel sector has struggled in 2025, with FLT in particular catching the eye, tumbling ~20% year-to-date. However, with a potentially aggressive rate-cutting cycle now underway, consumer confidence should improve, which, combined with more money in the pockets of mortgage holders, should create a tailwind for the sector. After recent share price struggles, the sector has attracted the attention of bargain hunters &/or suitors with rival Webjet (WJL) in the news of late:

- Earlier in the month, we heard that Melbourne buyout firm BGH Capital had raided WJL’s share register at 80c per share, taking its holding to ~10%.

- Over the weekend, we learned that fellow travel agent Helloworld Travel (HLO) bought another 5% of WJL, at around 85c per share, in Friday’s trading, also lifting its stake to around 10%.

HLO now owns a similar number of shares as the BGH and Weiss consortium, which has a 10.76% stake in WJL. Webjet Group has already rejected BGH Capital’s proposal to acquire a controlling interest in WJL, believing the 80c bid materially undervalued the company and would create significant uncertainty in the business. Many now expect HLO and BGH to join forces and make a play for WJL, with their intentions having been made clear.

- While the risk/reward towards WJL around 90c isn’t overly compelling, it shows that professional investors see value in the embattled sector.

Sector heavyweight FLT issued a disappointing trading update in late April with US uncertainty weighing on the FY25 outlook, primarily due to expectations for a weaker May/June period courtesy of macro uncertainty. FLT ditched its profit guidance, saying uncertain economic conditions and a fear of travelling to the US could reduce its earnings this financial year by more than $100 million. Market forces will come into play, with flights to the US likely getting cheaper, and those to Japan and Europe more expensive, but the net spend might not be as bad as feared. However, this is starting to feel as bad as it gets from our perspective, and with over half of the company’s revenue from Australia and NZ, yesterday’s move by the RBA could turn this negativity on its head. We found some positives in the April update, although an ~18% downgrade to earnings is never good, and the stock sank accordingly, plunging to post-COVID lows:

- A $200mn buyback when the share price (SP) is depressed makes sense and should help support SP weakness through 2025.

- FLT is doing a solid job on the cost front, plus they announced a targeted 15-20% capital expenditure reduction for FY26, placing the company in good stead when trading conditions improve.

FY26 earnings should improve as conditions stabilise, and if we see new business wins on the corporate level, the stock could rerate higher over the coming year, but of course, there is an ”if” in that sentence. Overall, we believe FLT is a play on local and US economic turnaround/consumer sentiment, with the RBA giving Australians a big lift yesterday, we’re just likely to travel to other destinations instead of the US.

- We like the risk/reward for FLT below $14, believing that the stock will benefit if/when we see a change in market sentiment towards underperformers.