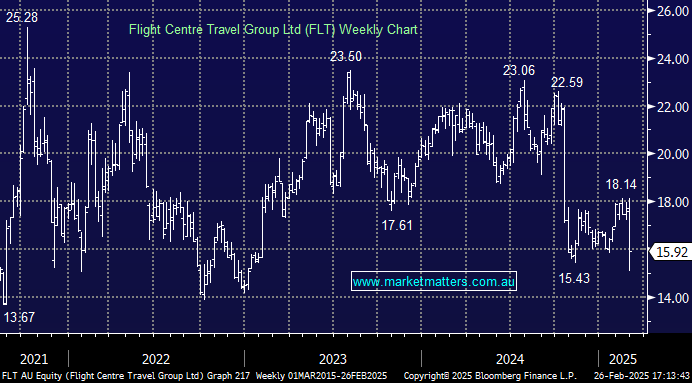

FLT –10.16%: Sold off heavily in trade today after a significant miss on 1st half 2025 earnings and pricing in the worst for the 2nd half despite management reiterating guidance range for the full-year.

- Total Transaction Value (TTV) $11.69b (+3.2% yoy)

- Revenue $1.33b (+3.2% yoy), estimate $1.32b

- Underlying earnings $192.7m (+0.8% yoy), estimate A$206m

The key driver of the miss was softer TTV as a result of airline deflation. We note while airfare deflation was higher than expected, volumes and ticket growth were strong with international outbound flights up +12% in the half.

FLT maintained their FY25 profit-before-tax guidance of $305-$405m and are ‘currently tracking towards low to middle of the range with consensus sitting at $379m. However, clearly the market isn’t willing to trust the historical 2H skew to earnings.