What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

April witnessed a bearish move by bonds and equities, driven by escalating interest rate fears as “sticky inflation” became a regularly used catchphrase across financial markets. Conversely, so far in May, we’ve witnessed a complete reversion in the market’s thinking/pricing for the future path of interest rates after both the Fed and RBA left rates on hold and delivered less hawkish rhetoric than many feared. Also, for good measure, markets embraced the recent “goldilocks” US employment data, which was a miss on job creation, while monthly wage growth slipped 0.2% from March; the latter was the number that caught most people’s attention.

- The Futures market now expects the Fed to cut interest rates twice by January, while the RBA is more of a 50-50 bet, although a rate hike is now largely being discounted.

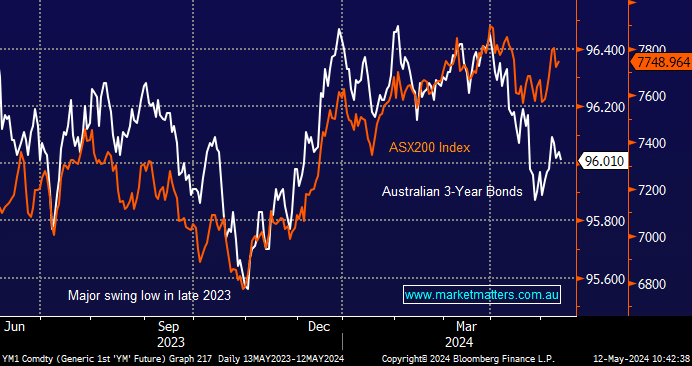

History shows us that the Australian 3-year bonds and ASX200 are very closely correlated; assuming MM is correct, and bond yields/interest rates do decline, this will provide a solid backdrop for equities over the next 12-18 months, but there are a few points we must consider moving forward:

- The ASX has outperformed the local 3s in 2024 on the belief that the “can has been kicked down the road” as opposed to interest rate cuts won’t be forthcoming; if this outlook wavers, stocks could repeat April’s decline.

- We expect the market to rally in a “3-steps forward, 2-back fashion” largely as we foresee ongoing bond volatility from data print to data print until the uncertain inflation clouds lift.

- Markets look at least 6 months ahead, right now, markets are pricing cuts, which is supportive. As/when these start to happen, it will be important to consider what is likely to come next i.e. if we get a couple of cuts then the expectation is for no more, it will be worth looking at taking some profits.

If we are incorrect, and rates are not going to just stay “higher for longer,” but further hikes eventually unfold, equities are set for a tough time, especially as they are already factoring in a stronger bond market/lower yields in the months ahead.

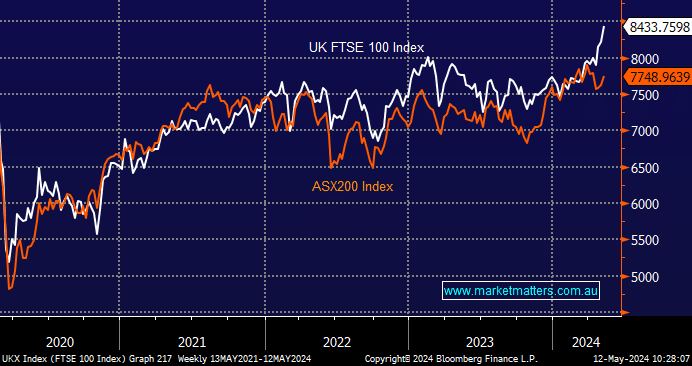

Over recent weeks, we’ve discussed the UK FTSE surging to fresh all-time highs and its strong correlation to the ASX due to their similar stock and sector composition. However, we thought it was about time we illustrated the point in a simple chart. Since COVID, the two indices have danced to a very similar tune until now when the ASX has struggled to keep pace with its UK peer; our preferred scenario is the local index will play some catch-up over the coming weeks/months, especially when BHP’s play for Anglo American (AAL LN) is clarified.

- We are looking for the ASX200 to catch up to the FTSE from a performance perspective, which would currently take it to the 8200 area.