What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Beijing has continued to pull the stimulus levers over recent months, but last week, in our opinion, was the first occasion when stocks noticeably built upon the initial optimism, sending the Resources Sector higher, e.g. BHP Group (BHP) +5.8% and Fortescue Metals (FMG) +9.4% with both encouragingly closing around their weekly high. As subscribers know, MM has been bullish on the resources sector, but there have been plenty of false dawns from both the sector and index this year. On balance, we believe it is time to be overweight the sector, especially considering the current fund managers’ positioning:

- Last week’s Bank of America Fund Managers’ Survey had “avoid China” as the most crowded view, with almost zero optimism toward the world’s second-largest economy.

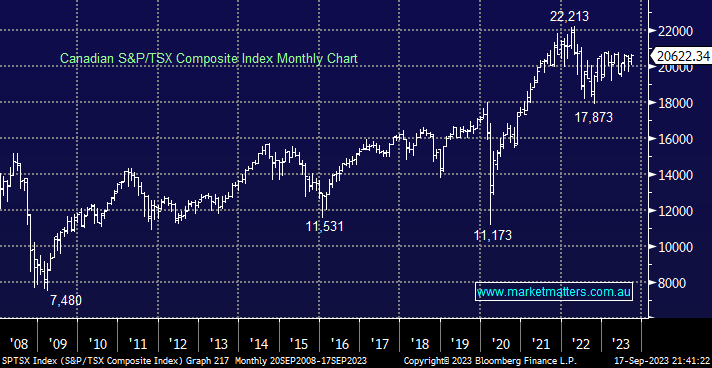

When we cast our eyes elsewhere, the picture is very similar, things are starting to look good but nothing is confirmed yet. The Toronto Stock Exchange, which has a similar composition to the ASX, is now only 1% below a fresh 15-month high and ~7% below a new all-time high. We are cognisant that this is a news-driven view, but China has made its intentions clear, fund managers aren’t yet on board, and one more solid session and the quant breakout funds look set to have their buy buttons triggered.

- We are initially looking for an 8-10% upside for the TSX Index, which is an exciting read-through for the ASX Resources Sector.

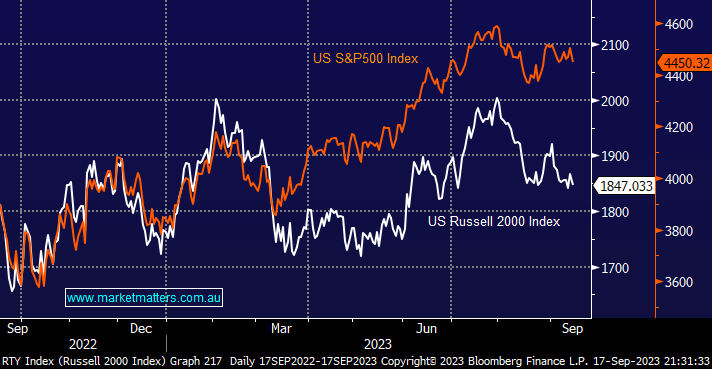

We looked at the US Russell 2000 Index last week, ultimately coming to a somewhat muted conclusion. However, when we compare the small caps to the larger end of town, and especially the Tech Sector, the picture is evolving somewhat differently. At this stage, it’s hard to determine in what manner the elastic band will snap back and when it will occur, but at this stage, we wouldn’t position ourselves for it to widen any further in Christmas – outperformance by the small caps is often regarded as “Risk On”.

- We expect the small caps to play some performance catch-up, a view which suggests the strong rally by “ big tech” which commenced in Q4 2022 is maturing fast.