What Matters Today in Markets: Listen Here each morning

Bond yields have fallen this week following the lower-than-expected Australian CPI and Jerome Powell’s statement post the Feds +0.25% rate hike which was received positively by risk assets i.e. it wasn’t regarded as overly hawkish:

- The Australian 3-Year Bond Yield closed on Thursday trading ~3.8%, substantially below this month’s peak at 4.26%.

- The US 2-Years are trading ~4.9%, even after this week’s hike, again below the earlier month’s high of 5.1% – they were lower before last night’s stronger than expected GDP result.

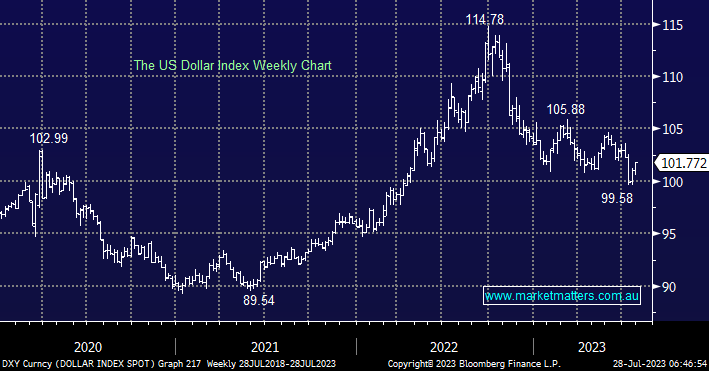

As subscribers know MM is bearish toward US bond yields through 2023 and if this outlook unfolds as we anticipate the likely path for the Greenback is also down, a great read-through for precious metals and to a lesser extent commodities in general. Overnight the ECB raised interest rates +0.25% as expected, while Christine Lagarde added that officials have an “open mind” on what to do next after 9 consecutive hikes took rates to 3.75% i.e. no great surprise as all central banks should be data dependant.

- Overnight the US 10-Year Yield hit 4% on stronger economic data from the US while rumours that the BOJ is considering tolerating higher bond yields at today’s meeting would have also been at play i.e. there’s still plenty of volatility left in the bond market.

- We remain bearish yields and on the $US but strong trends rarely giveaway without a fight and we anticipate a choppy 2H with a downside bias.

Thursday saw the ASX200 soar to levels not enjoyed since mid-February, for all the doom & gloom that pundits have been pedalling through 2023 the local index is now only 2.2% below its all-time high. The recent rally has been fuelled by hopes that we may see a pause/end to interest rate hikes by the RBA. On the result/news front yesterday the impact was largely negative with falls from the likes of Macquarie (MQG), RIO Tinto (RIO) and the coal sector making the markets broad-based +0.7% gain all the more impressive.

- No change, following the stimulus “talk” out of China and signs that the RBA is winning the battle against inflation we believe the path of least resistance remains skewed to the upside.

- The ASX200 is poised to open down -0.6% this morning following a similar decline by US equities as interest rate-sensitive stocks fell away in afternoon trade.

We are living in a strange paradigm where good economic news is taken badly as it implies interest rates will be hiked further e.g. US growth accelerated to 2.4% yesterday courtesy of a resilient consumer.

This morning we’ve briefly looked at 3 stocks that caught our attention yesterday with all of them amongst the market’s worst performers.