What Matters Today in Markets: Listen Here each morning

The markets love to roll out a saying, almost as much as an acronym, with “sell in May & go away” a definite favourite which is actually supported by solid statistics going back decades. However, this year while the press had a field day with stories on banking failures, looming recessions and a US debt crisis the underlying index has been quiet e.g. this month the ASX200 has traded in a noticeably tight 3.2% trading range, one of the smallest post-COVID. In other words, it may not feel like it to many subscribers but the markets are relatively quiet at the moment.

- It’s easy for investors to become unnerved by doom & gloom in the press but remember today’s newspapers are tomorrow’s fish and chip paper – sorry another cliché.

- One factor we notice talking to subscribers at the moment is how nervous people are, even though the market has traded higher through 2023.

The point we are trying to make is investors should formulate their own opinions on what the future holds for certain stocks and sectors as opposed to listening to people whose main motivation is getting “clicks” to sell advertising. Hence at MM we regularly spend our time analysing and forecasting major economic factors such as the $US and bond yields.

The $US is inversely correlated to commodity prices and especially precious metals e.g. since the $US has bounced +3.5% from its April low gold has corrected $US130, or 3.6%. Hence when we have a clear view of the Greenback it’s important that portfolios are positioned accordingly e.g. we’ve been overweight gold stocks while the $US tumbled more than -10% over the last 6 months.

- We are still looking for more from the current short-term bounce by the $US but medium to longer term we are bearish.

Bond yields have a huge influence across equities, since late 2022 we’ve watched tech stocks rally strongly as yields slipped lower and analysts tipped peak inflation/interest rates sooner rather than later.

- At this stage were neutral on yields because while we don’t believe central banks will hike much further in 2023 it’s hard to imagine them cutting rates even if/when the economy slows dramatically for fear of letting inflation back out of the bag.

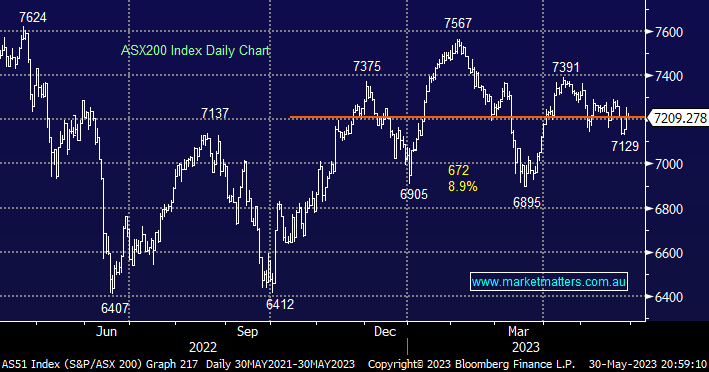

The ASX200 has now been rotating around the 7200 area for over 18 months with all the meaningful action continuing to unfold beneath the hood as opposed to on the index level e.g. so far in 2023 the index may be up +2.4% but the Tech Sector has rallied +25.8% but the Financials have fallen -3.2% over the same period. That particular much-discussed outperformance by growth stocks has largely been driven by markets focusing on a central bank pivot on interest rates i.e. the hiking cycle is coming to an end.

- We believe sector rotation will continue to dominate the market over the next 18 months hence we currently spend little time on the underlying indices i.e. a very different story than over the period between 2018 and 2020.

- No change, at this stage of the cycle we believe that a neutral stance is prudent i.e. better risk/reward is likely to present itself in the next 1-2 quarters, as the easy money from “long tech” is in the rear view mirror.

- MM is still carrying a 9% cash position in our Flagship Growth Portfolio affording us a degree of flexibility looking for the market’s next chapter, or two.

After last night’s weakness on Wall Street’s disappointing reaction to the US debt deal the SPI Futures are calling the local market to open down -0.5%, assuming we follow our US peers weakness is likely in the Materials and Consumer Staples Sectors e.g. BHP fell 60c in the US.