What Matters Today in Markets: Listen Here each morning

Last week we saw central banks demonstrate confidence in the global banking system by raising interest rates even while such moves have caused the very turmoil over the last few weeks sending the likes of Silicon Valley Bank to the wall and forcing Credit Suisse into a forced deal with UBS – let’s all hope this faith is not ill-founded and ultimately proves to be a mixture of stubbornness and impudence.

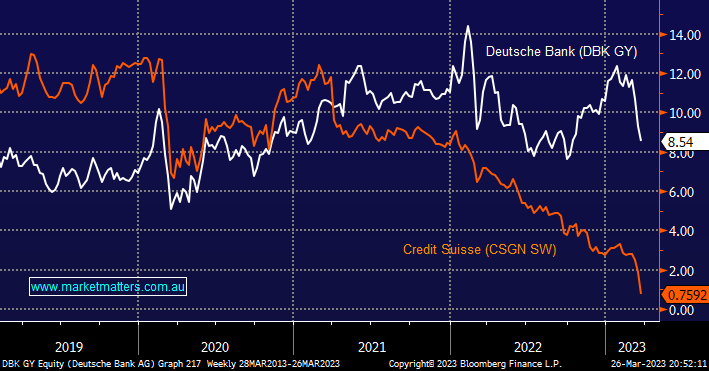

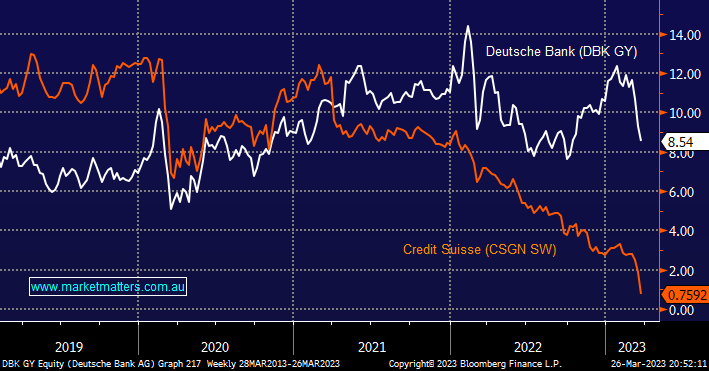

- Even as Credit Suisse crumbled & new concerns around Deutsche Bank have now arisen, the ECB hiked deposit rates by 0.5% to 3% after being negative less than 9 months ago – they now sit at a 14-year high.

- The FED hiked interest rates by 0.25% although they did suggest hikes are near an end, the upper bound is now at 5% after being at 0.25% just one year ago – US rates are now at a 15-year high.

Central banks have so far held their resolve but there are some very daunting numbers being carried on the balance sheets of the US banks due to the collapse in bond prices as interest rates soared – a recent academic paper quoted in Fortune magazines estimated that the total of unrealized losses sitting in the US banking system is around $US2 trillion. Of course, if securities are held to maturity, no losses will be realised, it is more of an issue when banks are forced sellers of these assets for a loss to cover outflows. With around 4000 banks in the US, it’s not surprising that people are transferring money to the larger better-capitalised names, I would, it costs nothing and is safer. In MM’s view, a broader deposit guarantee should be rolled out, it’s simply a no-brainer.

- MM believes the US banking system will remain firm but more intervention may still be required, especially if commercial property starts to hemorrhage as the smaller banks carry most of the sector’s loans.

At the end of last week, speculators started to “attack” Deutsche Bank, in our opinion, they are not comparing apples with apples but investors are concerned about the German bank’s exposure to US commercial real estate. We see no reason why DBK should see any contagion apart from the obvious psychological factors, we’ve avoided catching the falling knife around global banks but if the very profitable DBK breaks below its 2022 low it’s going to look tempting from a valuation perspective – a failed attempt by short sellers with DBK could ultimately restore confidence to the banking sector.

- We remain fairly comfortable that the regulators will end the current bank panic sooner rather than later, as the saying goes don’t fight the Fed.

- However we remain conscious that it’s likely to take time for the market to become confident enough to push the sector back toward its 2023 high.

The US KBW Banking Index fell 34% in 2022 and it appears to be enduring another major leg on the downside but we feel it’s now closer to its destination as opposed to its departure point. With volatility towards the sector rising almost daily and the commercial real estate market a very real concern deciding where to start accumulating is “best guess” work to a certain degree but another 10-15% and the risk/reward will look attractive in our opinion.

- The risk/reward is finally looking attractive for the US banks in the 60-70 region i.e. they’re rerating is maturing fast.