What Matters Today in Markets: Listen Here each morning

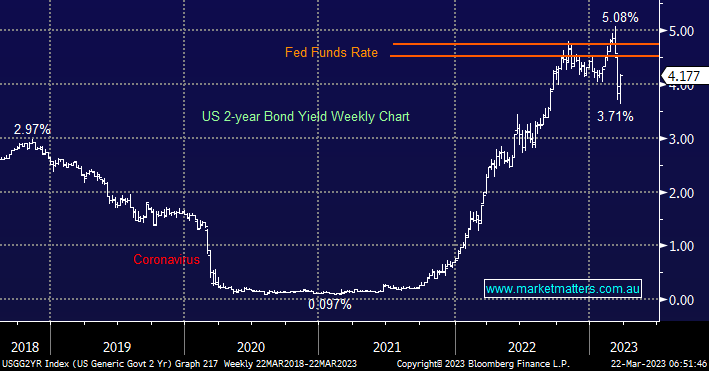

The US Fed has already hiked its benchmark fund rate eight times over the last year to the current 4.5%-4.75% target band, another +0.25% move is now expected at this week’s policy meeting even with bank failures causing a crisis of confidence in the US & Europe. Inflation hit a 40-year high in the last year and although the central bank’s aggressive monetary policy tightening has started to reverse this major economic problem as we know it has already come at a price with the US witnessing their 2nd & 3rd largest bank failures in history.

NB The Fed Funds Rate is the interest rate that banks borrow & lend money to one another overnight, this by definition dictates the borrowing cost on the likes of mortgages and credit cards.

Earlier in the week we felt there was an 80% chance that the Fed would pause from its hawkish path of rate hikes at this week’s meeting to allow calm to return to financial markets but on second thoughts in a poker-like bluff we believe Jerome Powell et al will indeed hike rates in an attempt to send a message to the market that’s its controlling both inflation and the US banking crisis – they are again walking along the gymnast’s beam!

- MM believes the Fed will hike +0.25% this week before pausing to assess the impact on its economy of the last year’s 8, perhaps 9, successive hikes – this is now being referred to as “the dovish hike”.

- The last 24 hours have seen markets migrate in this direction with both equities and bond yields rallying.

If the Fed can deliver the 0.25% hike accompanied by the correct balanced message we believe it will be taken positively by equities allowing the S&P500 to add to its recent gains.

Overnight we saw a solid night on Wall Street with the NASDAQ leading the advance, closing up +1.4% while the Dow added just 300 points. The stock market rebound is slowly gathering momentum helped by a surge in the Banking Sector as assurances from authorities continue to ease fears that the recent financial turmoil would lead to a full-blown crisis e.g. the VIX just had its largest 2 day fall since May with the “Fear Index” illustrating how quickly the “Fed Put” can take control.

- We are seeing the unusual scenario play out in the short term with the combined picture of rising rates as bank fears recede being bullish for stocks.

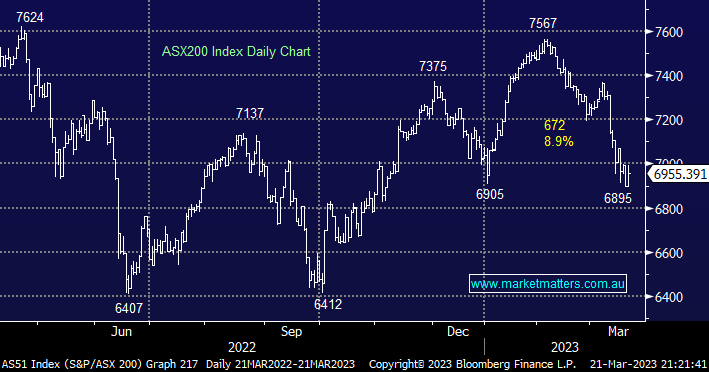

The ASX200 has now corrected -9.9% from its February high as the market again illustrates that elevated volatility is the new natural order of things, as we all know the banks have been the main area of concern but ANZ Bank (ANZ) for example is currently down less than -4% year-to-date, hardly a scary pullback on this side of the Pacific. MM remains committed to our “buy weakness and sell strength” mantra through 2023 and although we have a preference for the bullish corner we still wouldn’t be surprised to see another leg lower after a bounce towards the 7100 area i.e. remaining openminded and flexible is the key in our opinion to outperformance through 2023/4.

- We believe the ASX will embrace the fresh rollout of the “Fed Put” & a “dovish hike” making us short-term bullish into current weakness around 6950.

The US experienced a solid session overnight led by tech names with Amazon.com (AMZN US) +3% and Tesla (TSLA US) +7.8% catching the eye.

- Following the gains, on overseas bourses, the SPI Futures are pointing to a 60-point advance by the ASX200 early this morning with tech and banks likely to perform the heavy lifting.