- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX200 struggled on Tuesday under the weight of four major stocks tumbling by more than 10%, dragging the index lower from both a points and sentiment perspective. A strong banking sector couldn’t dig the bourse out of trouble, as health care and IT stocks were dragged underwater by sector giants CSL and WiseTech, each sinking more than 15%. The materials sector was also hit as investors took flight from gold stocks and critical minerals miners, with an impending US-China trade deal weighing on safe-haven appetite and bringing a recent rare earths rally crashing to reality. What caught our attention were more examples of the weak getting weaker, or surprises happening with the trend, short and long term:

- WiseTech (WTC) plunged -15.9%, for reasons we discussed yesterday afternoon (here): It was already down -25% year-to-date.

- CSL fell -15.9%, for reasons again discussed yesterday (here): It was already down 30% year-to-date.

- Lynas (LYC) tumbled -13.9%, the most in 4 years, after US Treasury Secretary Scott Bessent said he expects China to delay rare earth curbs: it had already fallen more than -16% over the last fortnight.

- Liontown (LTR) rounded out the worst 4 performers, closing down -12.8% on old-fashioned disappointing 1Q earnings, and especially high cash burn: the odd one out in terms of performance into Tuesday.

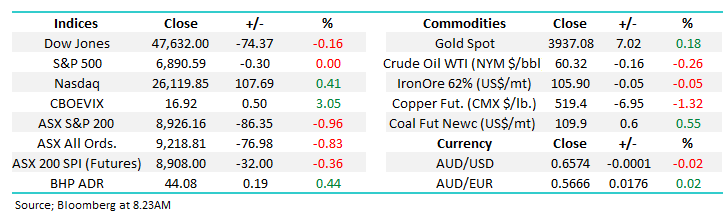

Michele Bullock didn’t help the already soft market, saying that the labour market is “a little tight”, inflation is sticky, and the RBA would require more data before deciding on interest rate cuts. It’s become a coin toss whether the RBA eases interest rates before Christmas, with a move on Cup Day next Tuesday looking increasingly unlikely, though todays September quarter inflation print due at 11.30am will be an important factor – Trimmed mean expected to be flat at 2.7% YoY.

- Traders have reined in their bets of a rate cut before Christmas, with Futures markets now pricing in only a 66% chance of some seasonal relief for mortgage holders.

The S&P 500 has provided a bullish tailwind that the ASX has failed to grab, trading basically unchanged over the last 2 months. US equities have hit another all-time high as Chinese and US trade negotiators lined up an array of diplomatic wins for Donald Trump and Xi Jinping to unveil at a summit this week. Easing trade tensions have helped fuel the stock rally, with US companies largely unscathed by tariffs, but optimism faces a reality check this week as investors look to the Fed meeting for clues on the path of rate cuts, while major technology firms, including Meta Platforms Inc. and Microsoft Corp., reveal whether the artificial intelligence-fuelled earnings momentum can be sustained – local moves by gold and critical minerals illustrate good things don’t always last forever!

- So far, almost 70% of S&P 500 members have exceeded 3Q estimates, the best performance in four years.

Overseas markets were mixed overnight, but the “AI Trade” keeps pushing US indices higher. In Europe, the German DAX slipped -0.1% while the UK FTSE rallied +0.4%. In the US, the tech-based NASDAQ advanced +0.7% supporting the broad-based S&P 500, which closed up +0.2%

- The ASX200 is set to open up +0.1% this morning, with gold names likely to bounce in line with moves in US ETFs.