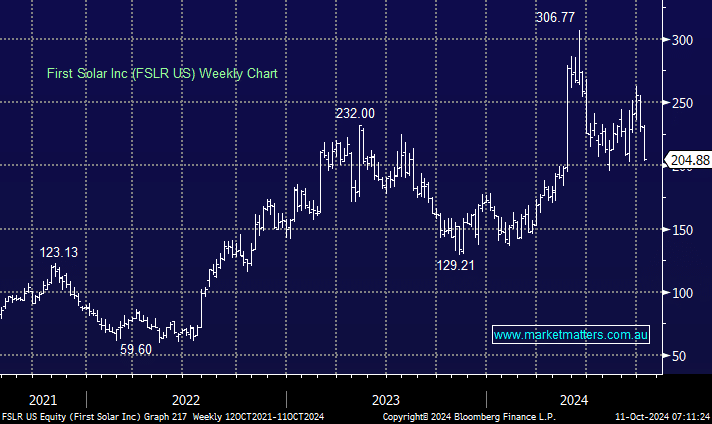

Two days ago, HSBC put out a very bullish note on the manufacturer of commercial solar panels with a buy rating and a bullish $358 price target. That bullish view was rebuffed overnight by Jeffries, who flagged the potential for a soft upcoming quarterly result due out later this month. Jeffries rejigged their price target lower, from $271 to $266 but maintained the buy rating, calling out delays in rolling our utility scale solar they think will impact the end of 2024 and into 2025. We suspect that firming odds of a Trump victory are also at play here, sending the stock down 9.3% overnight.

Trump has threatened to recut the landscape for subsidies provided to renewable energy companies if elected, and this is a risk to FSLR ahead of the 5th November vote. The flip side to this was US-listed coal company Peabody Energy (BTU), which produces primarily thermal coal used in power generation. Shares rallied nearly 4% overnight, hitting a new 12-month high and now within striking distance of its 5-year high.

- We own both FSLR US & BTU US in our International Equities Portfolio