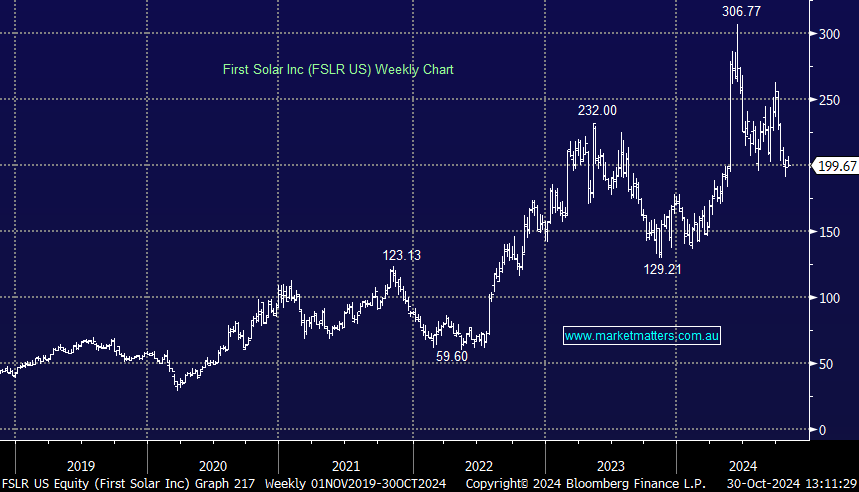

A weaker than hoped 3Q from FSLR released after market overnight, with a downgrade to FY24 guidance to boot – shares traded down ~2.6% after hours, having been down ~7% initially.

- Net sales of $US887.7m missed expectations of $US1.07 billion

- Earnings Per Share (EPS) $US2.91 versus estimate $US3.12

- FY Guidance lowered to net sales $US4.10- 4.25bn down from $US4.4-4.6 bn, with the market at $4.42bn

- Now sees operating income of $US1.48bn -1.54bn relative to consensus of $US1.54 bn, so a ~2% downgrade at the midpoint.

The stock has been weak into these results, and while they’re on the weaker side at the top line, management are doing a good job minimising the impact on earnings. A Trump presidency will likely be a negative for FSLR, though as we covered last week (here), there are some offsets.