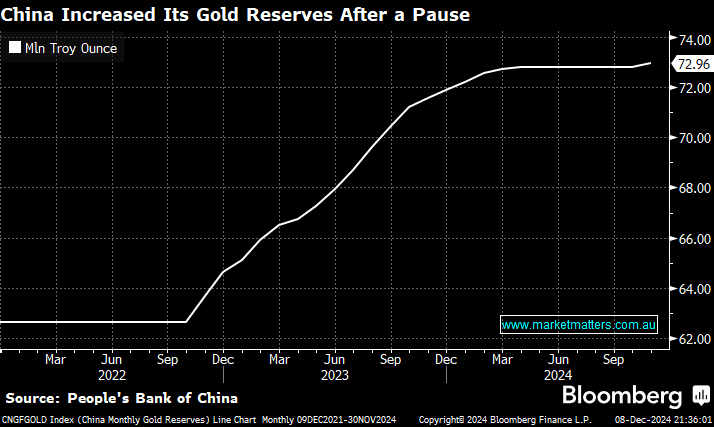

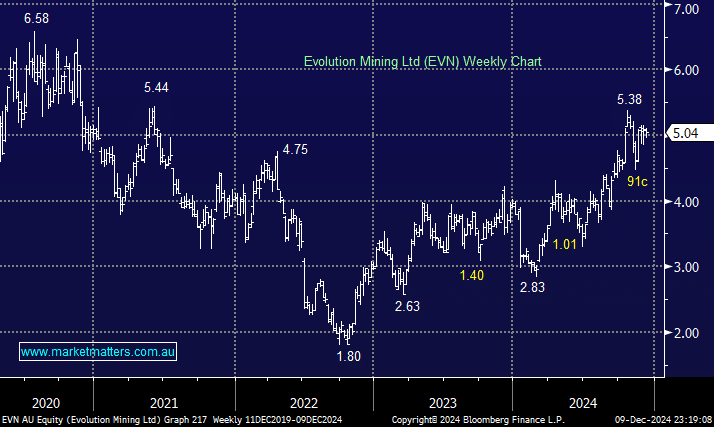

Moving on to today’s pick, EVN, a position already showing a 76% paper profit in our Active Growth Portfolio. China has been a major gold buyer in recent years, noticeably, its central bank expanded its gold reserves in November, ending a six-month pause after the PBOC had added to its stockpiles for 18 consecutive months until April this year. i.e., they are buying again.

- The resumption of purchases shows that the PBOC is still keen to diversify its reserves and guard against currency depreciation; this policy move could still be in its infancy.

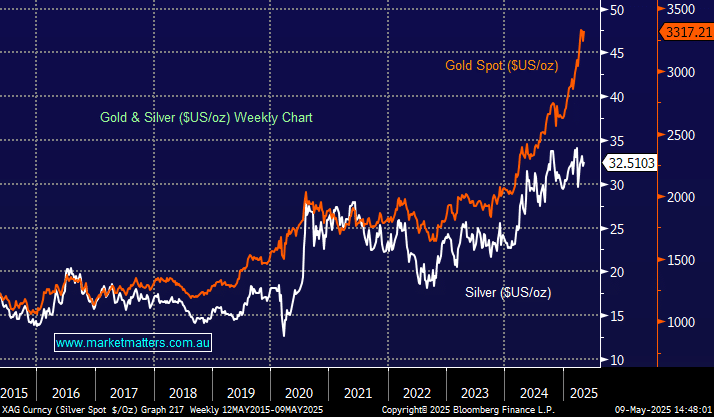

Like all commodities, gold is cyclical, but it’s in the middle of a bullish trend that could ultimately surprise many on the upside. EVN has been our preferred vehicle to play this move due to the company’s strong operational transformation in addition to its acquisition of an 80% stake in the NSW Northparkes copper and gold mine from China Molybdenum Co. (CMOC) this time last year when the price was gold prices were ~30% lower. EVN is now a 75% gold and 25% Copper play, and at MM, we’re also bullish on the industrial metal over the coming years, making EVN a great vehicle for exposure to our views.

- We are bullish toward EVN, looking for a break of its 2020 high through 2025/6.