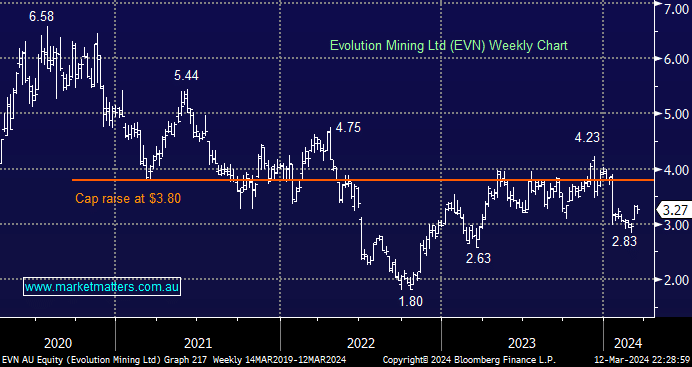

EVN waved goodbye to 2023 on the back foot, and it’s been a tough start to 2024, with the stock down -17.4% compared to Northern Star (NST), which is up +3.2%, there are two main reasons why this gold/copper play has struggled to keep pace with its peers:

- In December 2023, EVN raised $525mn at $3.80 to acquire an 80% stake in the cash-generating Northparkes copper-gold mine from CMOC Group.

- The stock was smacked in January after its quarterly results disappointed with production and costs well below expectations, although they maintained FY24 guidance.

Last month, EVN started to rebuild its credibility after reporting an underlying EBITDA of A$573m and an NPAT of A$158m, which was broadly in line with expectations—a welcome relief after January. The company has a rebuilding period ahead, but the stock has valuation support and trades on a relatively attractive free cashflow yield over the coming years. If EVN can prove the sceptics wrong and achieve its FY targets, the stock could be trading back around $4, aided by the tailwind of higher gold prices.

Recent acquisitions have significantly lifted EVNs’ resource inventory while stretching the average mine life out to 15 years. We continue to like EVNs’ copper (25%) and gold (75%) revenue mix moving forward. While it may underperform some of the higher-geared and purer gold plays if/when precious metals break above $US2,200, it remains our preferred exposure from a valuation perspective. Plus, we stay medium-term bullish towards copper.

- We can see EVN taking a touch longer to digest the December capital raise and large 2Q production miss announced in January, but moving forward, we believe EVN represents great gold and copper exposure ~$3.25.