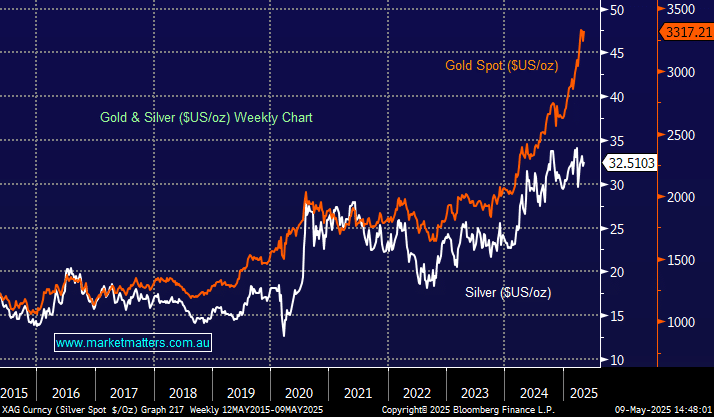

EVN +1.13%: posted strong performance across the board from production numbers and earnings through to positive news on the project development side.

- Underlying profit $385.1 million vs. $158.1 million y/y

- Interim dividend per share $0.070 vs. $0.02 y/y

- FY25 capex $445 million to $510 million, up from $365 million to $430 million

- FY25 production guidance of 710,000 – 780,000 ounces of gold and 70,000 – 80,000 tonnes of copper

- All-in Sustaining Cost (AISC) of $1,475 – $1,575 per ounce

A ~15% increase in capex to full-year numbers would normally see the share price under pressure, in the case of EVN it’s a huge positive, bringing forward ~$50m of capex from FY26 as it continues to execute on its Mungari process plant expansion which is tracking 6% below its original $250m budget.

- Evolution is hitting its stride and will continue to benefit from all-time high gold prices and momentum in the copper price, all the while executing in successive quarterly and half-yearly updates. We continue to like the stock and own it in the Active Growth portfolio.