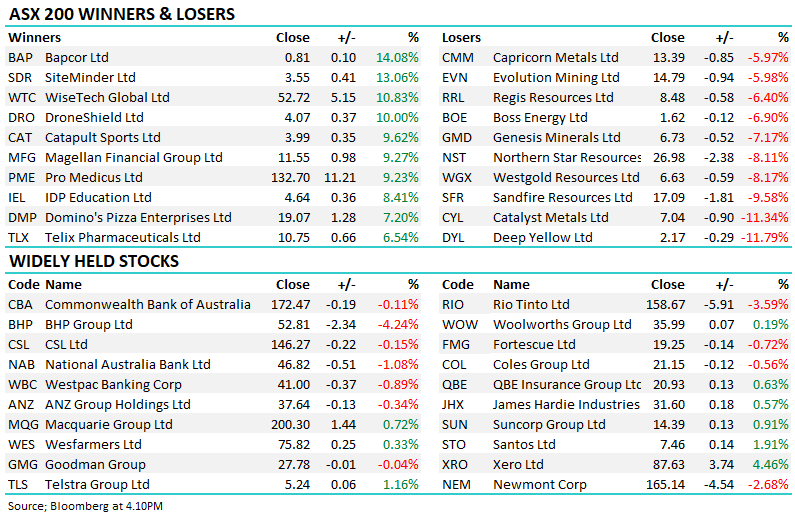

DUB +7.48%: the call recording and AI software company saw a strong ramp-up in recurring revenue despite a disappointing flow through to revenue, though this was previously flagged. Annualized Recurring Revenue increased by 50% to $59m, assisted by continued penetration within their service provider partners. Turning revenue into receipts continues to be a problem with the company recognizing $25.6m in operating revenue but only seeing $29.9m paid. They did flag that new processes had been put in place to improve collections in future periods.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

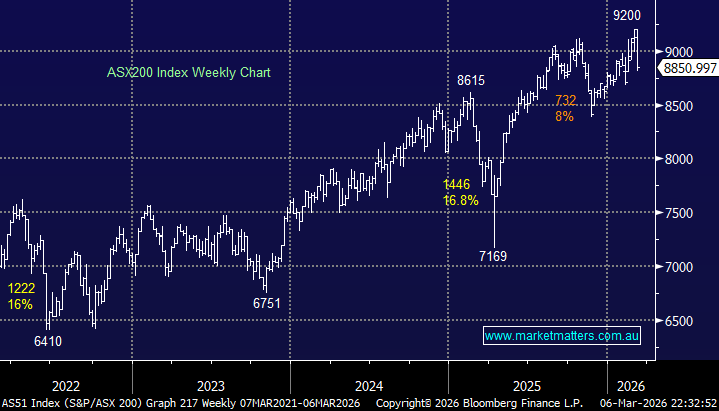

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

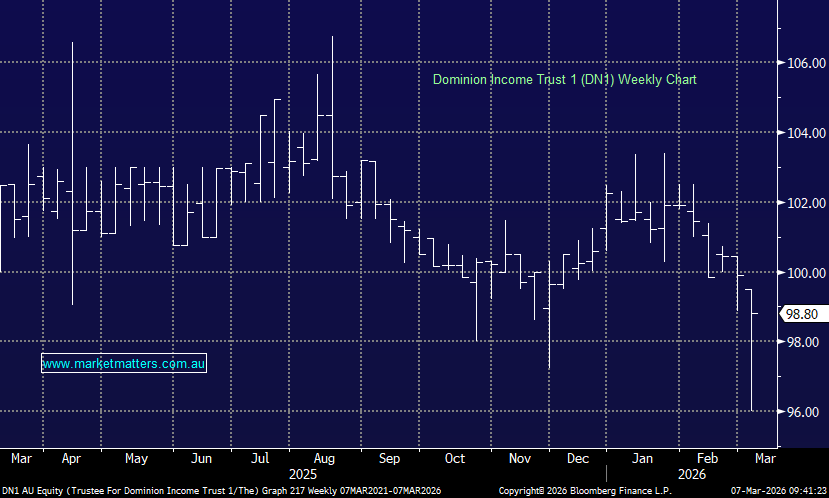

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

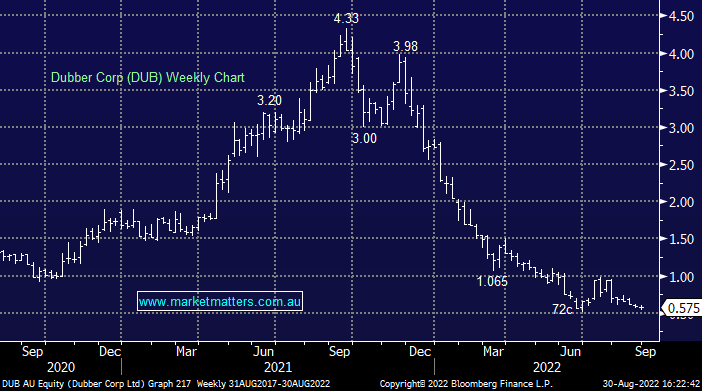

MM is cautiously bullish DUB

Add To Hit List

Related Q&A

Dubber Suspended!

MM’s thoughts on PBH & DUB

Update on 4 emerging company share positions

Question on sentiment & AD8/DUB

We are bullish Dubber (DUB)!

Thoughts on Family Zone (FZO)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.