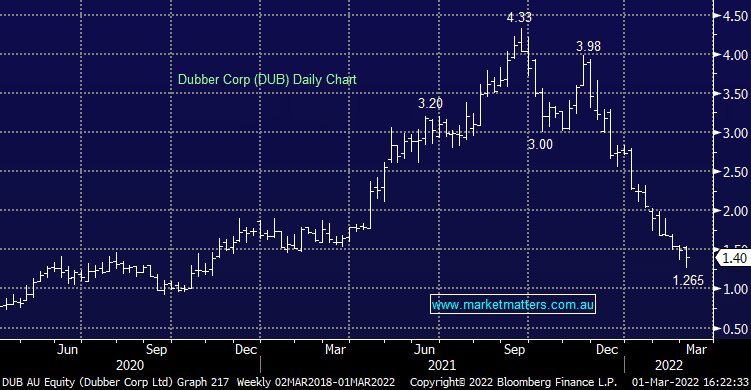

DUB -4.76%: cloud call recording and AI business Dubber reported aftermarket yesterday to wrap up the reporting period. The result was largely pre-released at the quarterly update in January with Revenue and ARR growth known. Costs have risen as they buildout their global headcount and integrate the technology on a number of large telco platforms. Also weighing on Cash Flow was a large debtor which is yet to settle, likely part of the reason for today’s weakness given no further update on when they expect this to settle. Shares did enjoy a bounce of the lows, there is certainly value in the name here.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

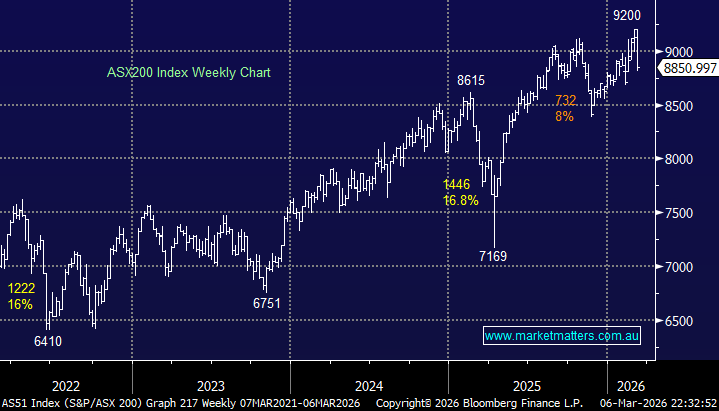

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

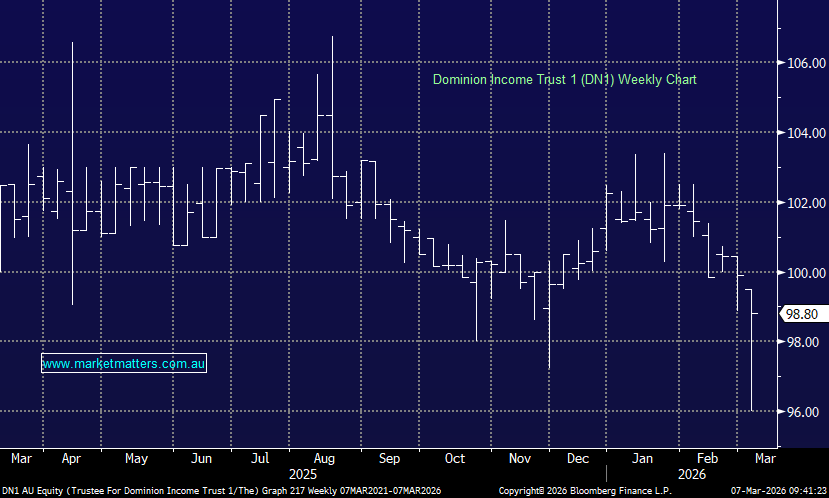

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

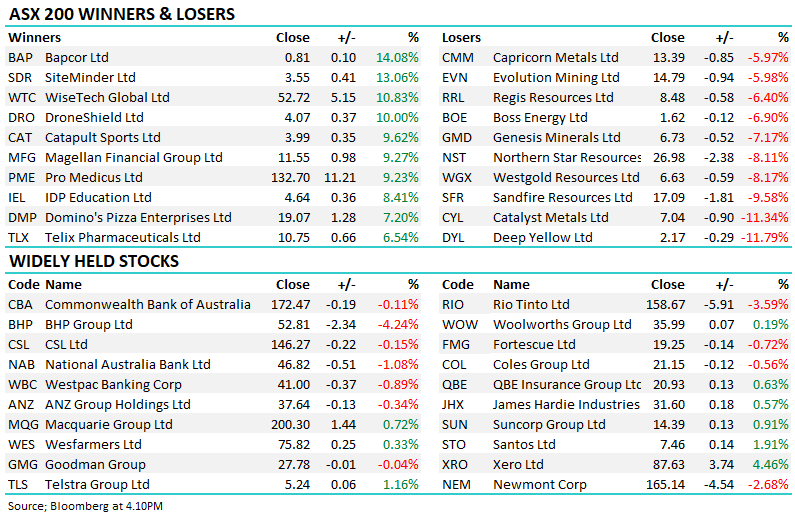

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM is bullish DUB

Add To Hit List

Related Q&A

Dubber Suspended!

MM’s thoughts on PBH & DUB

Update on 4 emerging company share positions

Question on sentiment & AD8/DUB

We are bullish Dubber (DUB)!

Thoughts on Family Zone (FZO)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.