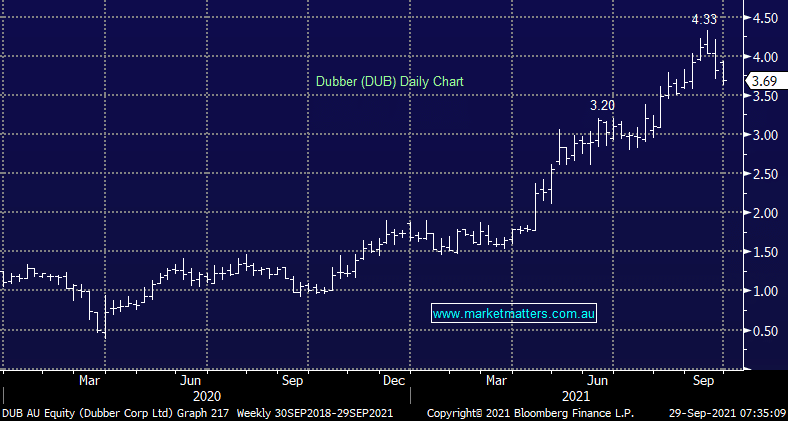

We have followed cloud calling & Artificial Intelligence (AI) business Dubber (DUB) from early in the year before seeing the stock run well ahead our buy area. Recently though it’s pulled back around 15% from all-time highs, putting it back on the MM radar. As a refresher, DUB have cloud call recording software that is being offered via partnerships with some of the world’s largest telco’s & technology companies. They are a world leader in what they do, which is essentially recording calls, analysing them and providing insight around what was said. For instance, if Market Matters used DUB software (we don’t) we could set up a notification if a combination of words that implied dissatisfaction was used on a call, giving us the heads up that this customer was potentially unhappy and us the chance to address it in a timely manner. Remote working is also a key tailwind for their offering. They recently raised a significant $110m to fund acquisitions which are starting to come through, last week they picked up Notiv, an AI lead notetaking business, in a small $6.6m deal. While not a huge uplift in sales, it does add to Dubber’s growing offering which is now accessible through a number of key North American telcos & cloud communications. Dubber’s revenue is set to double in FY22 organically – tack a few more acquisitions in and the path to positive earnings in a few years becomes clear.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is interested in DUB ~10% lower

Add To Hit List

Related Q&A

Dubber Suspended!

MM’s thoughts on PBH & DUB

Update on 4 emerging company share positions

Question on sentiment & AD8/DUB

We are bullish Dubber (DUB)!

Thoughts on Family Zone (FZO)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.