DOW is a large Australian integrated services company that designs, builds, and maintains infrastructure across transport, utilities, facilities, and energy sectors – so not as directly linked to mining as the others. On Monday, the stock closed only +0.9% higher, even after hearing they’d won a 15-year $750mn services contract from Chevron, which begins in January.

The stock is well supported by an ongoing buyback of over 33 million shares, or ~5% of the company. Like its peers, DOW is not cheap trading around 25% ‘expensive’. While they expect flat to slightly lower revenue in FY26, their focus is shifting toward margin improvement rather than top-line growth – we think this is a very sensible strategy. Too many in the sector over the years have taken on very low margin work, getting themselves into trouble, DOW included.

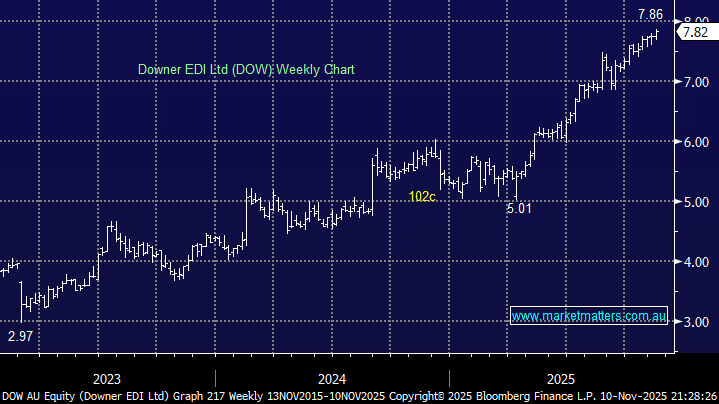

- We like DOW but wouldn’t be surprised to see the stock consolidate around the $8 area.