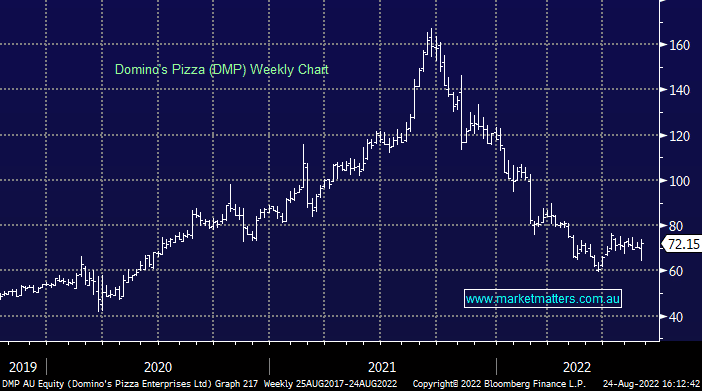

DMP +7.57%: FY22 results were soft for the pizza chain today. Revenue was a slight miss at $2.3b, while Net income missed consensus by~5% at $158.7m. They continue to grow store numbers, up 10% organically in the period, however, same-store sales growth fell by -0.3%. The company said pricing initiatives have helped to offset food, labour and energy inflation, particularly across APAC. Also announced today was the purchase of minority shareholders of the Malaysia, Singapore and Cambodia Domino’s businesses, taking their share in these markets to 100% which is expected to be 5% EPS accretive, perhaps offsetting the disappointing numbers today. They’ve also reaffirmed 3-6% same-store sales growth and 8-10% of organic store additions as their medium-term target.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral DMP at best

Add To Hit List

Related Q&A

Broker price targets

Turnaround Opportunities

DMP/CKF as possible growth/dividend stocks

DMP & Chemist Warehouse

Does MM like Dominos (DMP) capital raise?

Does MM like CKF &/or DMP?

What are MM’s thoughts on Domino Pizza?

Relevant suggested news and content from the site

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.