In June’s MM’s Resources into FY24 webinar one saying that came out on a couple of occasions was “It’s cheaper to buy than build” with BHP’s takeover of OZ Minerals (OZL) a standout example. Yesterday we saw major activity on the share register of Liontown Resources (LTR) which led us to reconsider whether other local lithium names could find themselves in the sights of overseas/local companies looking to grow through acquisition.

Half of the lithium mines put on the market since 2018 have been bought by Chinese companies for an estimated $12.3bn illustrating the country’s appetite for global battery metal although future moves may prove far harder with national interests likely to be put ahead of shareholders. Chinese car/battery makers are also taking steps to secure supply by taking over 20 stakes in lithium, nickel and cobalt companies with demand set to surge over the coming decade – lithium is already being referred to as “White Gold” while the US Energy Dept. has declared lithium as essential to the economic or national security of the US.

- Future M&A activity is going to come under increased scrutiny from regulators if the ultimate beneficiary is an overseas entity.

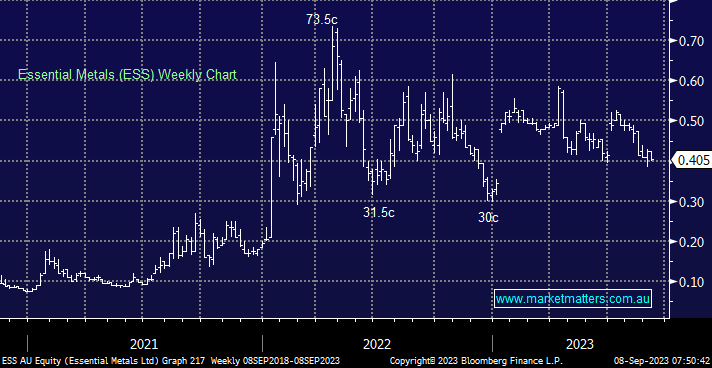

At this stage, local mining giants such as BHP haven’t considered the sector because earnings wouldn’t move the dial on their balance sheet but never say never as the industry evolves i.e. this is unlikely to be a playing field for the large end of town over the next 12 months. However, this remains a hot/active space, back in April we saw Mineral Resources (MIN) strategically scupper plans by Tianqi and IGO to acquire lithium explorer Essential Metals (ESS) – the stock subsequently fell significantly with the takeover off the table, MIN offered no explanation for its 19% blocking stake.

- We believe the lithium sector will remain volatile and news-dominated through 2023/4.

The lithium sector is dominated by small and mid-sized firms in Australia, the world’s number 1 producer of the electrical vehicle (EV) battery ingredient. The sector has delivered some extremely volatile returns as it goes from hot to cold on a regular basis e.g. Liontown Resources (LTR) has doubled this year while Lake Resources (LKE) has tumbled over 75% – it’s a volatile space that’s not for the faint hearted!

This morning we’ve looked at 4 ASX lithium stocks from the more conservative end of town in line with our Active Investor approach as opposed to being the speculator – we have always regarded M&A potential as cream on the cake as opposed to the outright reason to purchase a stock.