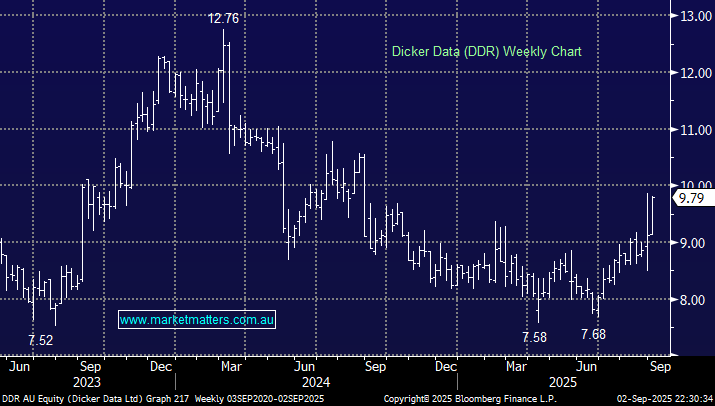

The same trends that propelled Harvey Norman (HVN) to new all-time highs this week are playing out in Dicker Data. The technology refresh cycle, driven by cloud/AI hardware upgrades, and Windows 10 end-of-life, is underpinning a strong recovery in DDR earnings after a fairly subdued couple of years. 1H25 results released on the 28th August showed a strong +15.7% rebound in revenue along with healthy profitability across both Australia and New Zealand.

They also provided full-year guidance that we viewed as very positive, now expecting Gross Revenue of $3.7–3.8bn, which represents growth of over 10% on last year. While this is a low-margin business serving customers in the SME sector, their profit before tax (PBT) expectation of $120-124mn was ahead of our numbers, and ahead of many other analysts, prompting upgrades across the board. The consensus price target now sits at $10.52.

- They announced an 11c quarterly dividend, equating to 22c for the half (fully franked), with another 20c tipped in the 2H. While the share price rally has now pushed their yield down to 4.3%, we view this as very sustainable and likely to grow.