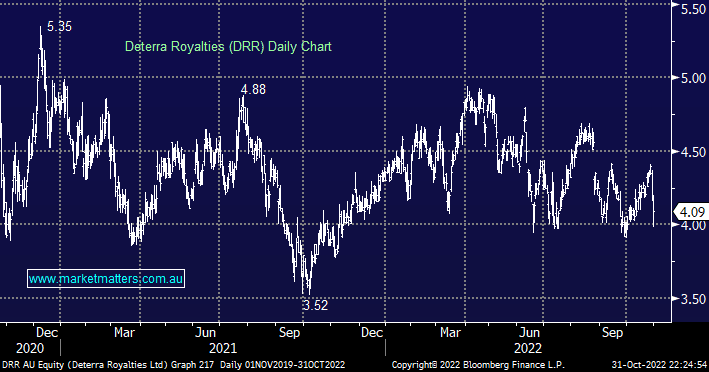

DRR has struggled over the last few days as iron ore royalties fell by ~25% in line with the underlying bulk commodity. DRR is a royalty scheme from one of BHP’s assets and the company simply passes 100% of the earnings through as a dividend, we do like DRR as a dividend play and it’s definitely an alternative to the large miners who can come with higher operational risk. When Iron Ore bottoms, this will be a good way to play upside in the sector.

- We like DRR as a dividend play, it’s currently forecast to pay more than 6% over the next 12 months.