Hi Carl,

The simple answer is no, DRR is a royalty scheme from one of BHP’s assets and the company simply passes 100% of the earnings through as a dividend. They were just spun out of Iluka (ILU) which is effectively the opposite of a takeover. If thinking about takeovers, it’s important to recognise that these generally happen because the suitor can add value to the asset acquired, or the asset that’s acquired will add value to their existing operations i.e. 1+1=3. Given DRR has no operational input, we would view a takeover as highly unlikely.

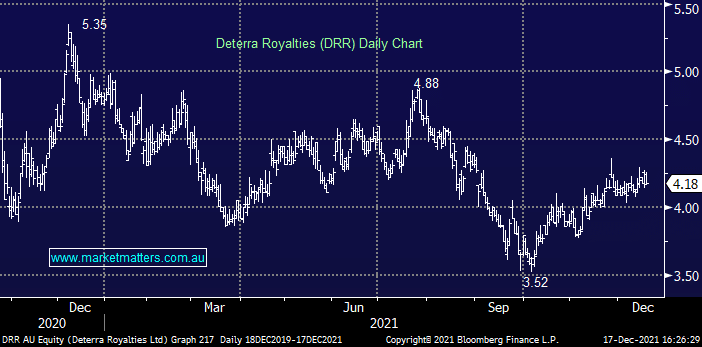

In terms of share register, more parties with larger amounts of stock makes it harder. As an aside, we do like DRR as a dividend play and it’s definitely an alternative to the large miners who can come with higher operational risk.