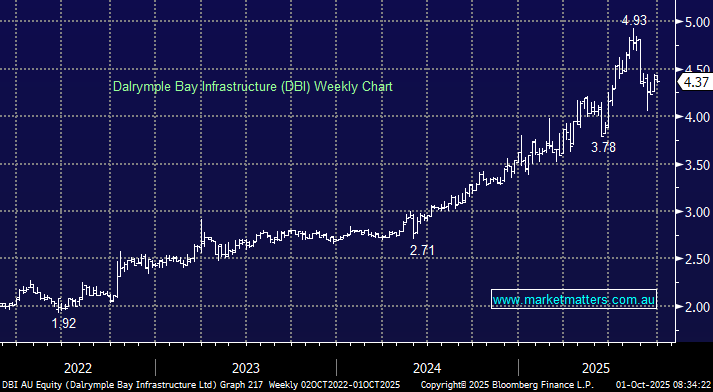

There has been a lot going on in DBI in recent months, with its inclusion in the ASX 200 index and the complete sell-down by its largest shareholder, Brookfield. The exit played out in two blocks. The first came in June, when Barrenjoey handled the sale of 115m shares for $428m at $3.72, a ~7% discount to the prevailing price. That represented ~23% of the company, though Brookfield still retained ~26%. The shares subsequently rallied ~25% before pulling back.

Brookfield returned in September, coinciding with DBI’s pending ASX 200 inclusion, offloading their remaining ~130m shares at $4.05 (a ~6.9% discount). That sale marked the end of their position. Shares have since recovered to $4.41.

Brookfield was the majority owner of DBI before floating it on the ASX in December 2020 at $2.57 per share. At IPO, the stake was worth ~$655m; across the two block trades, Brookfield realised ~$955m. On top of that, they collected ~$250m in dividends across 4.5 years, equating to over $600m in profit (excluding franking credits). Not a bad outcome — a ~60% return from an asset that was considered difficult to list at the time.

So, should we be following Brookfield out the door?

The short answer is no. Brookfield’s exit looks more about timing than fundamentals. Large investors like Brookfield routinely recycle capital, and five years is a typical window for such moves. Importantly, the sell-down has facilitated DBI’s inclusion in the ASX 200, improving liquidity and broadening its potential investor base.

- We continue to see the combination of reasonable earnings and mid-single-digit distribution growth, underpinned by take-or-pay contracts, as supportive of DBI’s role as a solid dividend-paying infrastructure stock. In our view, recent weakness presents a buying opportunity.