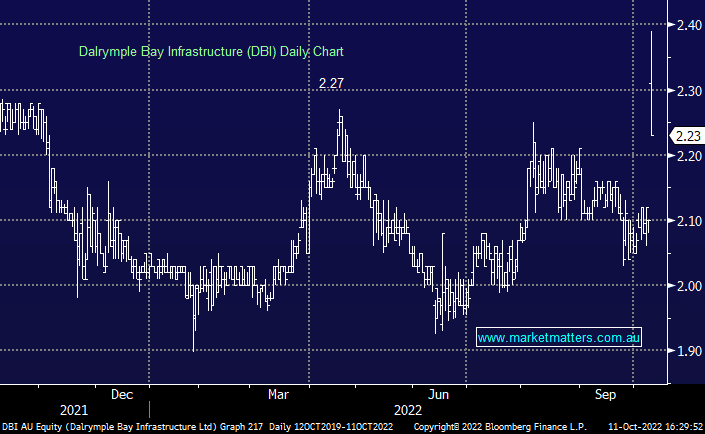

DBI +6.19%: the port owner upgraded guidance on the back of relaxed regulation, sending the stock higher today. The terminal infrastructure charge will increase to $3.18/t, applied retrospectively from July 1, 2021, bringing in a windfall of $61m for the backdated charges. The new price is an increase of 29% on the previous agreement which rolled off last year. Distribution guidance for the remainder of the year has been increased 10% to 20.1cps, and 3-7% growth p.a. over the medium term is now expected on the new pricing model. It’s taken longer than expected to secure the pricing increase, however, today’s update provides more certainty around earnings and income for shareholders for a number of years, creating a low risk earnings stream.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is interested in DBI for income

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on Dalrymple Bay Infrastructure (DBI) and Sigma Healthcare (SIG)

What is happening with Dalrymple Bay Infrastructure (DBI)

Coal stocks and related companies

Your view on various stocks

Thoughts on Dalrymple Bay (DBI) for yield

Does MM like Dalrymple Bay Infrastructure (DBI)?

DBI & PPS, MM thoughts

DBI & PDL – MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.