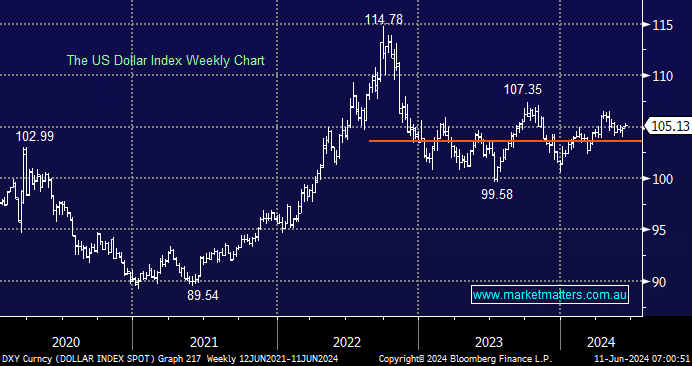

The Greenback bounced last week as Fed rate cuts were put on ice, but the move hardly registered on the chart as the 105 holds for the $US Index, which measures the US currency against a basket of its major trading partners. Again, it has already been 18 months of trading in the current area, and it’s akin to a game of 2-up forecasting when it will push towards 100 or 110.

- We are net bearish on the US dollar through 2024/5, initially targeting a retest of the psychological 100 area.

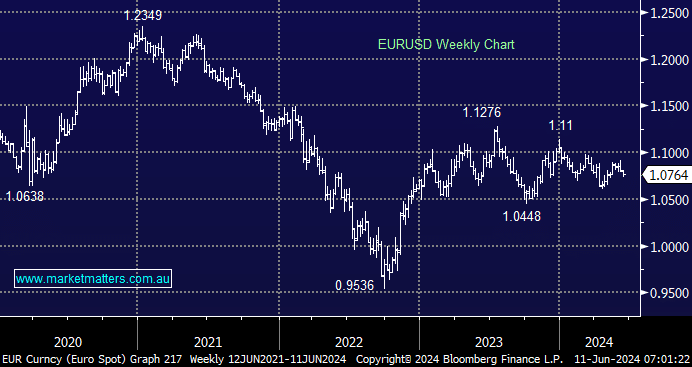

The ECB cut interest rates last week, as was largely expected, but what did broadside traders was French President Macron’s call for a snap election, one he could easily lose to Marine Le Pen of the far right. Macron’s dissolution is an extraordinary gamble by the French leader, who has just lost his parliamentary majority after winning a second term as President just two years ago—as we said earlier, markets hate uncertainty.

- We are targeting a break of 2023 highs by the Euro moving forward, but first, a retest of 1.05 may be on the cards after Macron’s decision.