The Greenback experienced a very quiet week, considering the CPI was released on Friday. With economic releases showing few surprises in either direction, both bonds and the $US trod water for a second week. Ultimately, we are looking for the $US to retest and eventually break its 2023 low, around the 100 level. However, again, after trading sideways for over 12 months, it’s guesswork as to when the $US will go in search of a new level of equilibrium.

- We are net bearish on the US dollar through 2024/5, initially targeting a retest of the psychological 100 area.

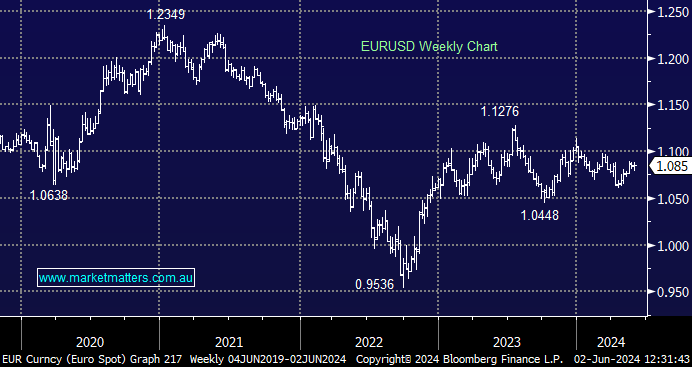

The ECB is set to cut rates on Thursday, ahead of the Fed, yet its currency is gaining strength since its panic sell-off into late 2022 lows. It has been 18 months since the Euro moved with any conviction in either direction, but it “looks and feels” poised to break over the coming months, and although this is not a reason alone to take a position, it does support our overall macro view for a lower $US and US bond yields.

- We are targeting a break of 2023 highs by the Euro moving forward, with the million-dollar question being when.