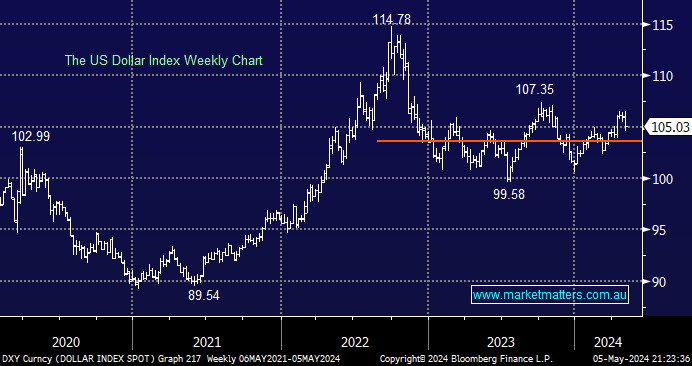

The Greenback pulled back to the 105 area last week, led by a small pullback in bond yields following the relatively dovish Fed rhetoric and employment data. The US dollar has remained in the same 100-107 trading range for the last 18-months, and although we’re net bearish, it needs a catalyst before seeking a new level of equilibrium.

- While we still remain net bearish on the US dollar through 2024/5, for now, it looks comfortable around 105.

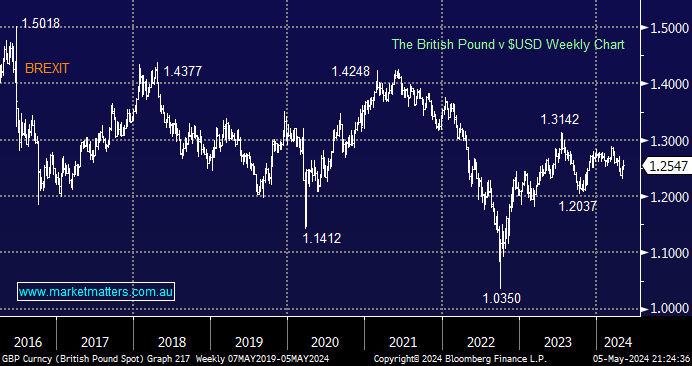

Cable (The British Pound), as it’s referred to on FX trading desks, has continued to trade around its average price since BREXIT, although there have been 20% swings in both directions over the ensuing years. “Guessing” when the Pound will experience its next major move is fraught with danger, but if we’re correct, the catalyst will be a rally in bond markets (yields lower), the when being the million-dollar question.

- We’re initially targeting the 1.40 area for the Pound, and after consolidating for well over a year, a move could be in the offing at any time.