The Greenback broke out to a fresh 2024 high on Friday, as its “safe haven” status attracted plenty of buying into the weekend as well-founded fears around Iran gathered momentum. The short-term gyrations of the US dollar are likely to be determined by ongoing news flow out of the Middle East, and it’s likely to take a while before markets become fully calmed. Volatility is likely to persist this FY.

- No change; we remain net bearish on the US dollar through 2024/5, but a “pop” above 107 in the short term wouldn’t surprise us.

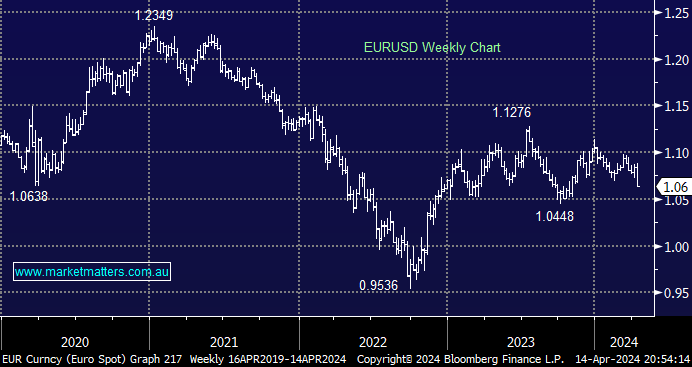

The Euro fell away on Friday in line with the strong US dollar. The downside momentum looks likely to extend further as the appetite for “safety” remains. However, the risk/reward would be appealing if we see a washout on the downside below the 2023 1.045 lows. In a similar fashion to the Nikkei mentioned earlier, this would generate a risk/reward “buy trigger” for MM.

- We can see the Euro spiking down towards the 1.04 region, where we would be keen buyers.