The $US continues to move in tandem with bond yields; hence, if we are correct in 1Q, it’s a buy around 100 and sell nearer to 105. We remain ultimately bearish on the $US, but as rate cuts get pushed further down the track in 2024, it’s unlikely the Greenback will make a foray under the psychological 100 level. In simple terms, a strong US economy keeps both yields and the $US elevated.

- No change; we remain net bearish towards the $US, but some ongoing consolidation/volatility feels likely in the 100-105 region.

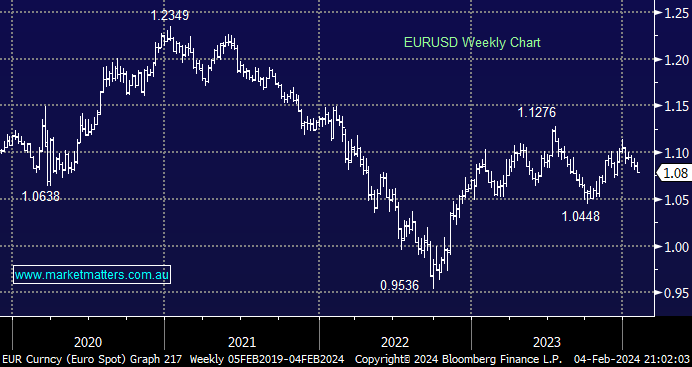

The EURO has rotated around current levels for over a year, and while it’s easy to say a breakout is due, markets have a habit of taking longer than expected before breaking out in a new direction.

- We remain bullish towards the EURO, but while it continues to rotate between 1.05 and 1.10, attempting to forecast when it will move to a new equilibrium level is guesswork at best.