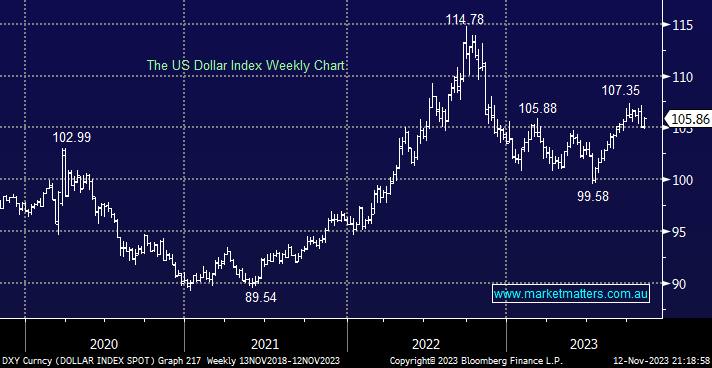

The $US edged higher last week after mixed messaging from Fed officials left markets second-guessing if the $US rally from the psychological 100 area was running out of steam; we can see more of the same, believing its short-term direction is a 50-50 call into 2024.

- While we remain net bearish towards the $US, a clear direction on interest rates will likely be required before the Greenback can turn meaningfully lower.

The USD-Yen is extremely close to making fresh 30-year highs following the Fed rate hikes while the BOJ maintains its extreme accommodative policy, i.e. interest rates at zero. The interest rate differential has made it far more appealing to hold $US, but if/when the BOJ does start to lift rates as inflation picks up we can see a retest of the 130 region. From a risk/reward perspective, we can see more downside from current levels, but further upside looks likely in the short term.

- We remain bullish towards the Yen and bearish on the USDJPY medium term, but the short-term trend remains up.