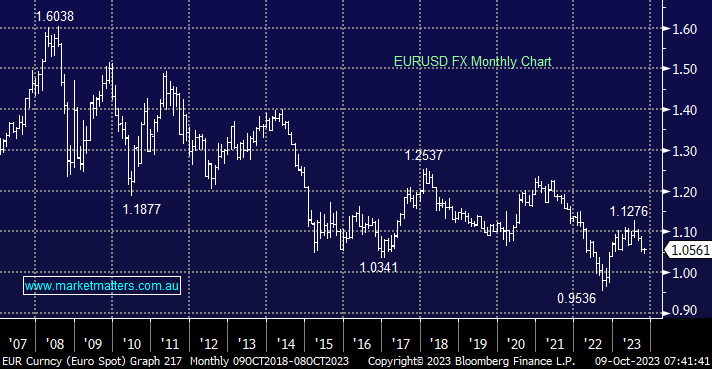

The $US reversed further gains late last week in an encouraging sign for risk assets, but it’s likely to enjoy a safety bid this morning, e.g. the Aussie has opened down -0.45% versus the $US.

- We remain net bearish towards the $US, but the short-term war in Israel is likely to keep the Greenback firm.

The Euro has corrected back to our targeted 1.05 region, and our preferred scenario is it will regain the strength it exhibited through most of 2023, a great read-through for equities. This morning’s minor -0.25% dip following the events in the Middle East illustrates the likely muted early reaction across financial markets and the Euros underlying strength following the pullback over the last four months.

- We believe the Euro can test above the 1.20 area in 2024.