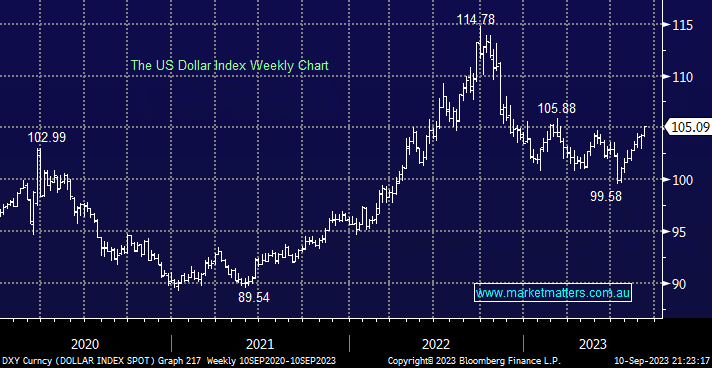

The $US ended last week testing 105 resistance area following rising fears of Fed rate hikes courtesy of ongoing economic solid data. We believe the “easy money” for the contrarian investor is behind us with what comes next likely to be very data-dependent.

- In line with our view on US bonds, we’re net bearish towards the $US, but the short-term bounce may last a touch longer, as has been the market’s nature through 2023.

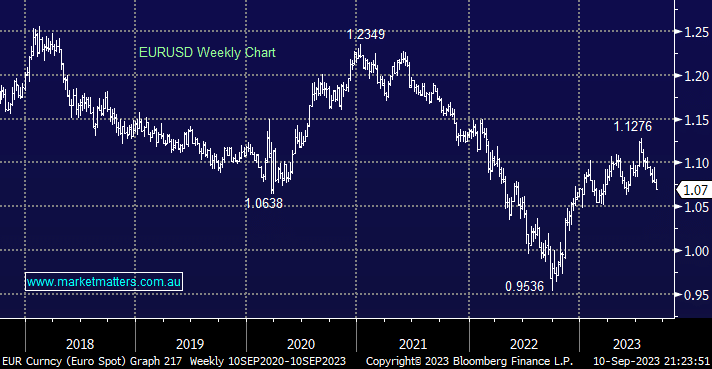

The Euro has continued to correct back towards 1.05, as we expected, what comes next is a tougher call but our preferred scenario is the we see the uptrend regain its momentum over the coming weeks/months which should be bullish towards equities and especially the Gold Sector.

- We can see the Euro testing the 105 area but we believe it should now start “looking for a low”.