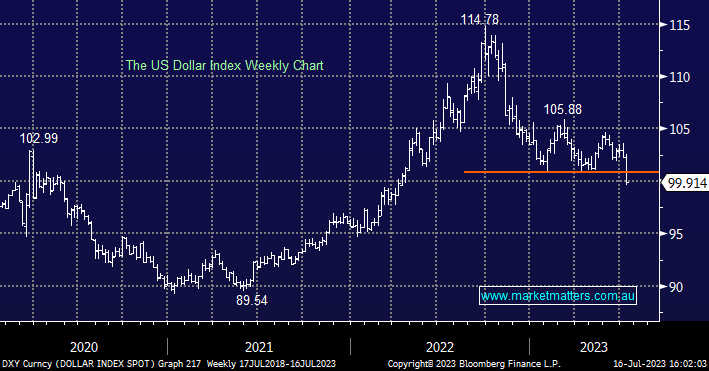

The $US fell under the psychological 100 area last week following yields lower, one of our core views at MM through the 2H is that short-dated yields will fall back toward their 2023 lows suggesting that the Greenback has much further to fall over the coming quarters.

- Following the US CPI and drop in bond yields the $US fell to levels not seen in over 2 years, in line with our view on US bonds we’re looking for another 10% on the downside.

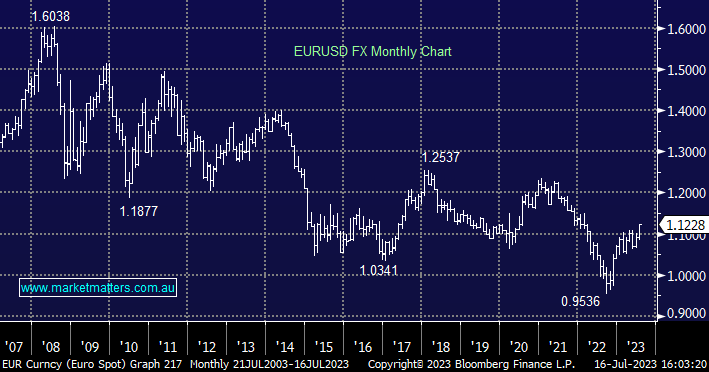

The Euro was one of the main beneficiaries of the drop by the $US, it tested its 2022 high with further gains looking like just a matter of time. Similar to our view toward the Pound which was discussed last week we are bullish toward the Euro targeting a test of the 1.20-1.25 area, a move which again coincides with our outlook on bond yields.

- We like the big picture toward the Euro with an initial test of 1.20 our preferred scenario over the coming year.