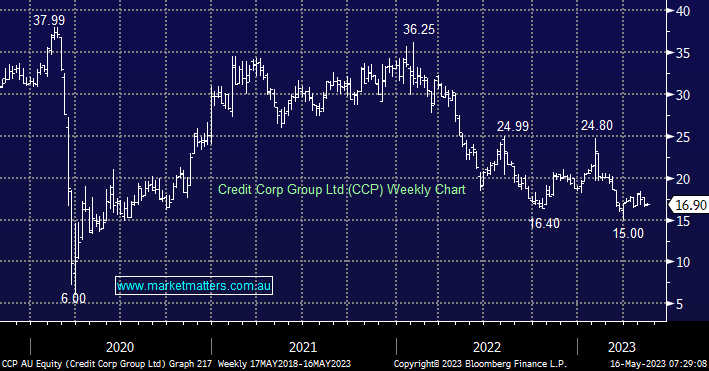

Debt collection company CCP has already fallen -16.7% this financial year but with interest rate hikes starting to bite the consumer we believe debt ledgers will become more readily available as people struggle with rising repayments across their various borrowings i.e. we have all heard about the “mortgage cliff” about to unfold in Australia. The availability of debt to purchase is critical for CCP earnings, it is essentially their inventory.

- After more than halving over the last 18 months we believe the risk/reward has finally swung in favour of the buyers of CCP.