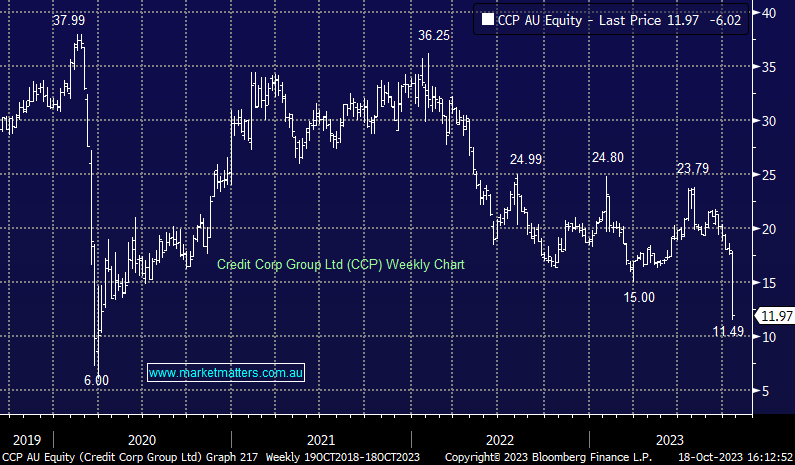

CCP -30.53%: the debt collector fell to 3-year lows today after taking a knife to asset values and guidance. The company said collection conditions had continued to deteriorate after flagging the higher delinquencies at results in August. As a consequence, the company has reduced the value of their US Purchased Debt Ledger (PDL) assets by $45m, or -14% given the company now expects lower returns over the medium term. In the immediate future though, Credit Corp has downgraded NPAT (before the impairment) by 10.5%, or $10m to $80-90m in FY23. We struggle to see how Credit Corp will get back on track in the near term given how expensive PDL’s are against a backdrop of weaker collections – something needs to give!

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bearish CCP

Add To Hit List

Related Q&A

TYR SCG CCP & RMD

Your thoughts on TYR, MFG & CCP please

MM’s thoughts on CCP, CHC & GMG?

MM’s thoughts on CCP, CCX & CHC v GMG

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.