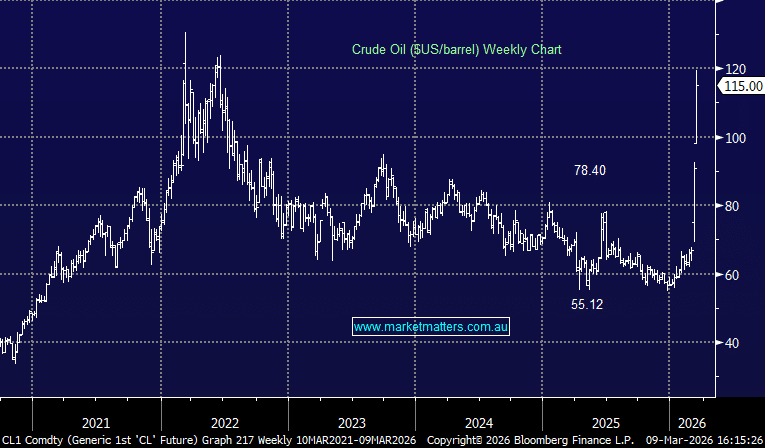

Brent crude edged lower on Friday and last week, although interestingly, the Energy Sector surged +2.5% on Friday night AEST. Oil has been in the same trading range for almost 2 years, and there are no signs this is about to end into Christmas. However, a number of the related ASX oil stocks are starting to find some support, albeit around two-year lows.

- We believe crude oil is “looking for low”, with moves like Friday night suggesting a pivot could be close at hand for the related equities.

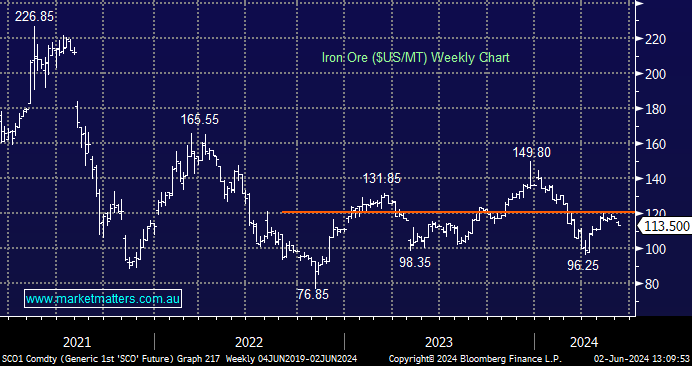

Iron ore has been consolidating the 20% advance from its early April low over recent weeks; overall, positive price action, in our opinion, although the bulk commodity miners have endured some steep pullbacks at the same time. Last week, the International Monetary Fund raised its forecast for China’s growth this year to 5% from 4.6% previously due to “strong” first-quarter figures and recent policy measures. China’s economy grew by a better-than-expected 5.3% in the first quarter, supported by strong exports. With China showing signs of improvement, we can see further upside in China-facing commodities and stocks, i.e. iron ore.

- We believe the risk/reward favours exposure to iron ore on dips by the bulk commodity to ~$US110/MT area.