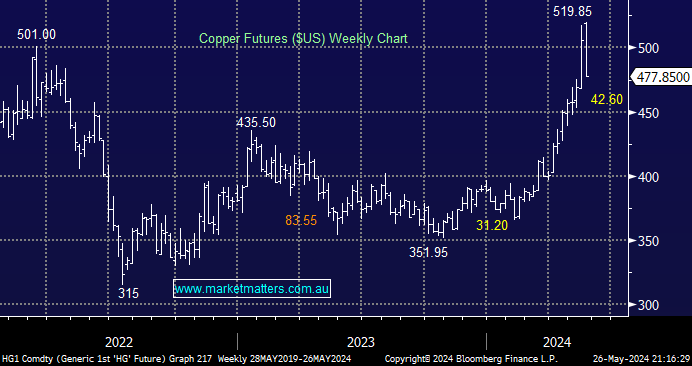

Copper exploded to new highs earlier this month in a classic “blow off” style move, and while we remain bullish, a period of consolidation akin to that witnessed at the start of the year is now our preferred scenario. If we are correct, the buying will return to the copper stocks shortly as investors look for “bargains” in a sector many believe will trade higher over the coming years as the world strives for a cleaner planet.

- We are bullish on copper, but after this year’s major advance, a few months’ consolidation looks to have commenced.

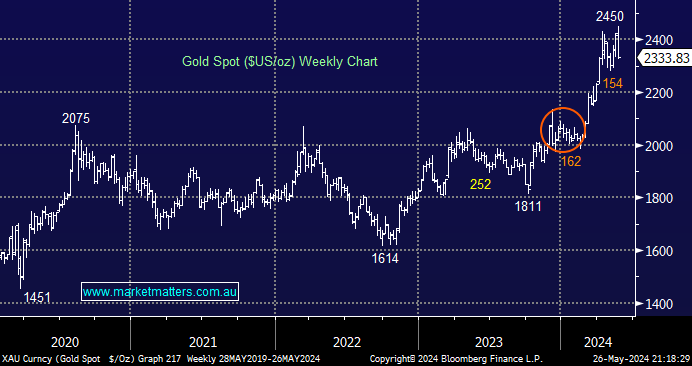

Gold danced a similar jig to copper last week courtesy of the Fed’s hawkish comments. We can see it testing ~$US2300 over the coming weeks, but we still believe it’s in a “buy the dip” position until further notice.

- We believe precious metals can continue their advance through 2024/5, with bond yields and the $US set to decline, providing a major tailwind.