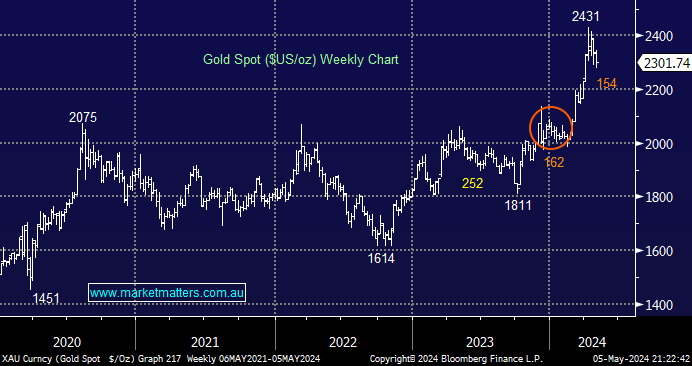

Gold has been consolidating recent strong gains over the last few weeks. If it follows the rhythm of its pattern earlier in 2024, it should be “looking for a low” in the coming weeks while spending a bit more time between $US2300 and $2400, ultimately a good read-through for both bonds and stocks.

- We believe the risk/reward now favours the gold bulls around the $US2,300 level after its recent 6.3% pullback.

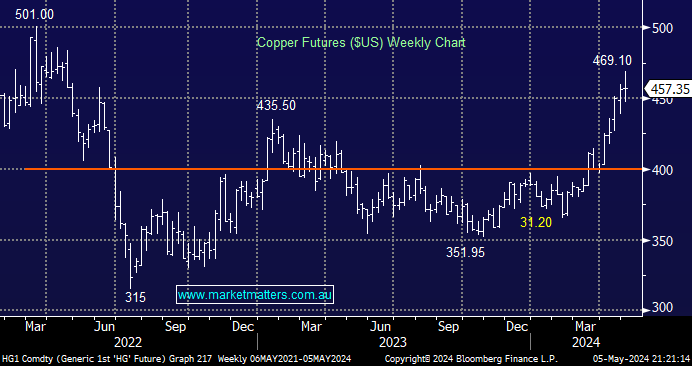

As subscribers know, MM agrees with BHP chief executive Mike Henry’s repeated warning that there is not enough copper to electrify the global economy and meet climate targets. As we know, in all financial markets, when demand outstrips supply, prices rally, by definition making more money for the respective miners. Hence, BHPs grab for copper assets, i.e. in 2023, they bought OZ Minerals (OZL) for $9.6bn; now they’re after Anglo American (AAL LN), whose copper assets dwarf those of OZL.

- We remain bullish on copper, although a few weeks’ consolidation now feels likely after it posted fresh multi-month highs last week.