Iron ore has defied many bears over recent months, with the bulk commodity continuing to trade around $US120 even as Beijing struggles to reignite its economy as the property crisis continues. We remain optimistic that the targeted stimulus by Xi Jinping et al. will eventually turn around the world’s 2nd largest economy, which will prove a bullish catalyst for iron ore. i.e. in FY22, over 80% of Australia’s exported iron ore went to China.

- We remain short-term bullish towards iron ore, but more cautious in the medium term due to looming supply.

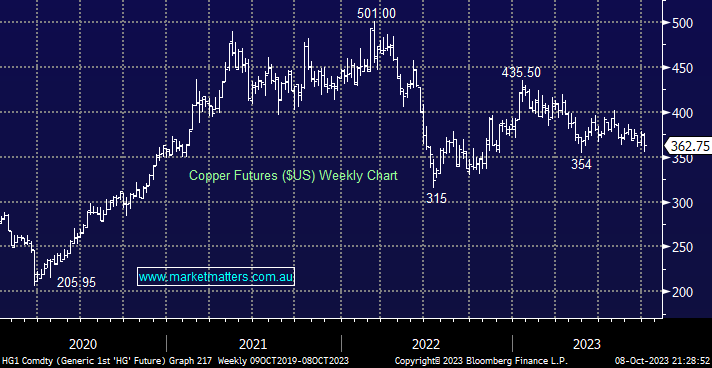

Copper slipped lower last week on growing recession fears as long-dated bond yields continued to push higher, the weekend events in Israel are likely to exacerbate the move as uncertainty around oil supply is a headwind for global economic expansion.

- We are bullish toward China and copper, but an initial break under $US3.50 still feels like a 50-50 prospect.