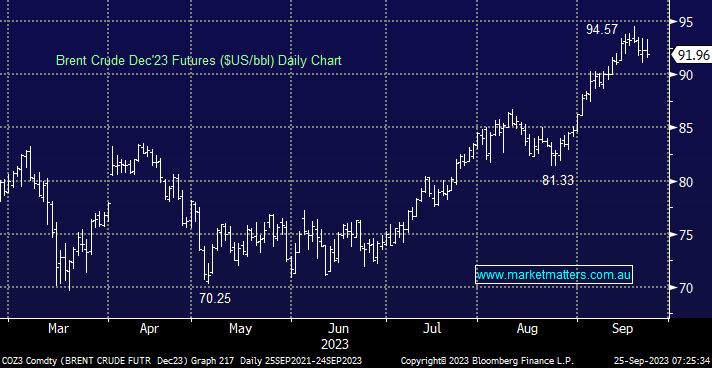

Brent crude oil finally paused at the end of last week after pushing higher throughout the month. At this stage, it’s nothing to upset the bulls, just a logical reaction to the hawkish Fed commentary. Central banks would love a lower oil price to help them combat inflation, but it looks unlikely until we see an end to the Russian embargo and, hence, by definition, the Ukraine war.

- we remain bullish towards crude oil, with a test of the psychological $US100 a distinct possibility into Christmas.

- we are still considering trimming our overweight energy position into further strength over the coming weeks/months.

Copper slipped lower last week following the Feds commentary, which caused concerns that interest rates holding higher for longer may really hurt global growth, something which is becoming increasingly hard without meaningful participation from China.

- We are bullish toward China and copper, but an initial break under $US3.50 still feels like a 50-50 prospect.