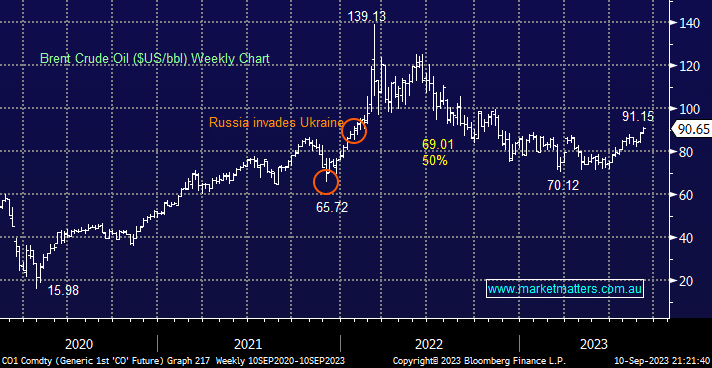

Brent crude oil continued its march to a fresh 6 month high last week on ongoing supply concerns after Saudi and Russia extended supply cuts last week. Prices are up almost 30% over the previous 3 months, contributing to the increasing global concerns that inflation will remain strong – Imagine where it would be trading if China’s economy kicked back into gear!

- No change; we remain bullish towards crude oil with a test of $US100 resistance a possibility

- Trimming our Energy Sector exposure into further strength over the coming weeks/months remains in our playbook.

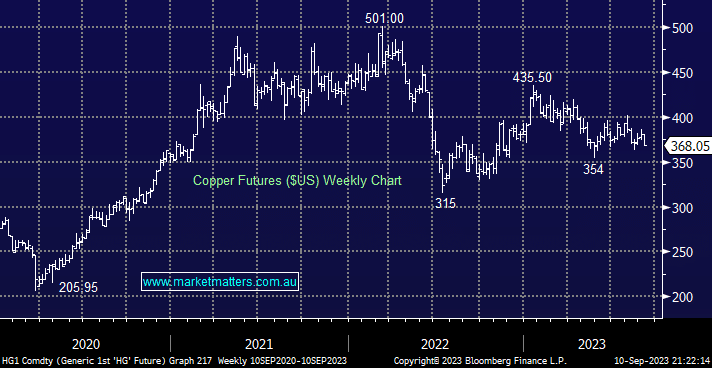

The copper price continues to rotate around stimulus news out of China plus fears that the Fed might again hike rates – it’s been a very balanced equation over recent months. We believe the short-term gyrations of copper remain a coin toss, but increasing demand will send prices higher over the medium/longer term.

- No change; we are keen accumulators of copper exposure into fresh 2023 lows.