CKF owns KFC and Taco Bell franchises, which will compete with GYG. However, it didn’t enjoy any residual buying from the phenomenal IPO on Thursday, with the stock remaining close to its 2024 low, down over 20% year-to-date. In its FY24 first-half result, CKF demonstrated KFC Australia SSS (same-store sales) growth of 6.6% and KFC Europe SSS growth of 8.8%. It’s also steadily opening more KFC outlets in Australia and Europe, improving its scale benefits. That HY24 result saw the company’s revenue rise 14.3% to $696.5 million and underlying NPAT increase 28.7%.

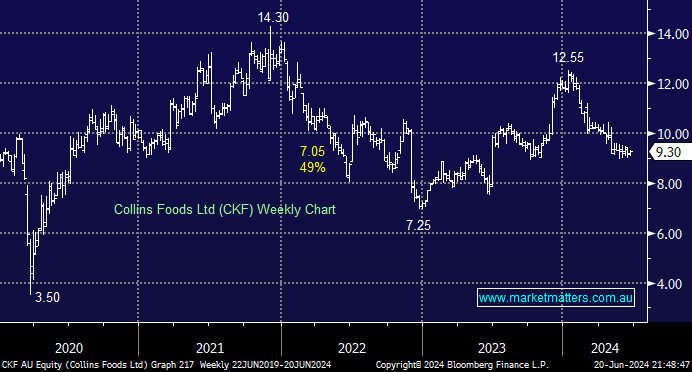

- CKF has traded around $9 for the last two years, and we see no reason to fight this sideways trend. However, value has returned, with a useful ~4% fully franked yield also on offer.