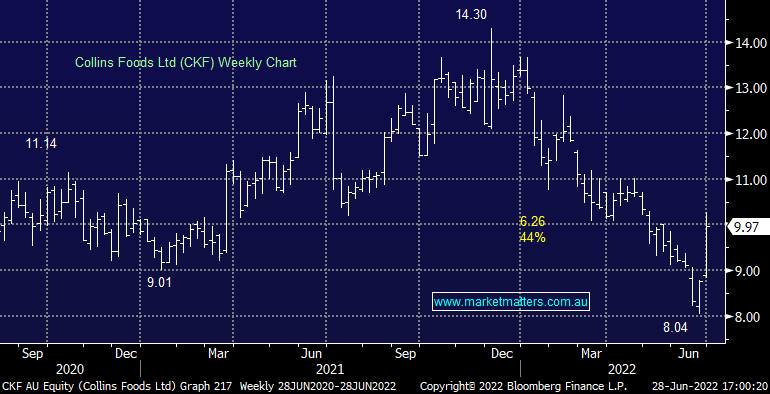

CKF +11.52%: Full-year results out for the KFC franchise owner today were impressive despite what was largely expected to be a soft period. Revenue was a slight beat at $1.18b, but NPAT was around 5% ahead of expectations and up 68% in the year. Same-store sales growth was strong across the board for KFC Australia (+1.4%) and Europe (~17%), though the junior Taco Bell segment saw negative comps. Margins were solid despite cost pressures as they put through price hikes to offset food and wage cost increases. FY23 has also started well with same-store sales growth continuing to impress, up 4% in Australia and 15% in Europe. They expect to open over 20 stores across their brands in FY23 to further drive growth.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral CKF

Add To Hit List

Related Q&A

DMP/CKF as possible growth/dividend stocks

Does MM like Collins Foods (CKF) after its dramatic plunge?

Does MM like CKF &/or DMP?

MM insights on CKF

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.