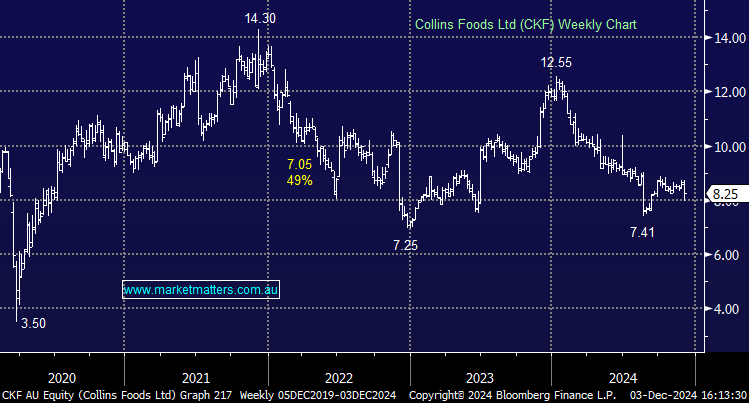

CKF -4.29% had a tough time today after a softer than expected 1st half FY25 result.

- Revenue up 1.2% y/y to $703m vs. $709m consensus

- NPAT of A$23.7 million, down 27% from A$31.2 in H1 FY24

- Interim dividend A$0.11 vs. A$0.12 consensus

Whilst there is some positivity in a turnaround for sales in KFC Australia for the first 7 weeks of FY25 (+3.9%), the business is struggling in its KFC Europe (-1.6%) and Australian Taco Bell (-1.4%) segments. The company is pushing forward with expansion, planning seven new restaurants this year, but rising costs and tight margins are proving tough to navigate.