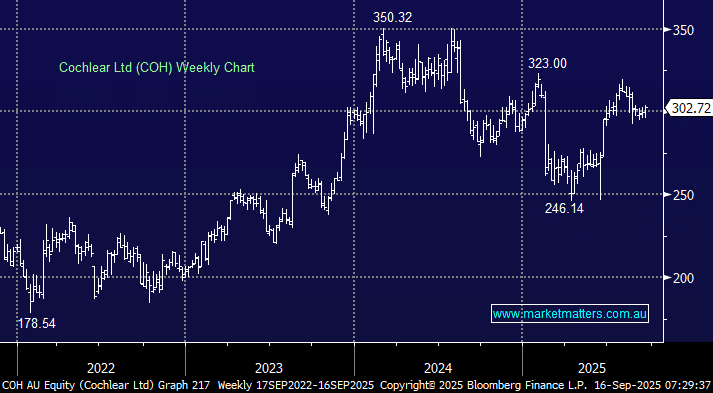

COH had a quiet report last month after flagging much of the result in June which at the time saw the stock surge back towards $300. The company is pinning its hopes on the rollout of a new hearing implant called Nucleus Nexa to boost earnings after this year’s disappointing performance, although net profit still grew 9%. After 20-years of delivering, we see no reason to doubt COH’s next chapter. Like a classic school report card, there are plenty of areas where COH can improve moving forward, from weaker-than-expected gross margins, small market share loss and a decline in revenue from its servicing of implants in the US.

- We like COH ~$300, it’s trading one standard deviation below its 5-year average valuation, improving the risk/reward at current levels.